Guide: How do I develop an effective sustainability strategy for my company?

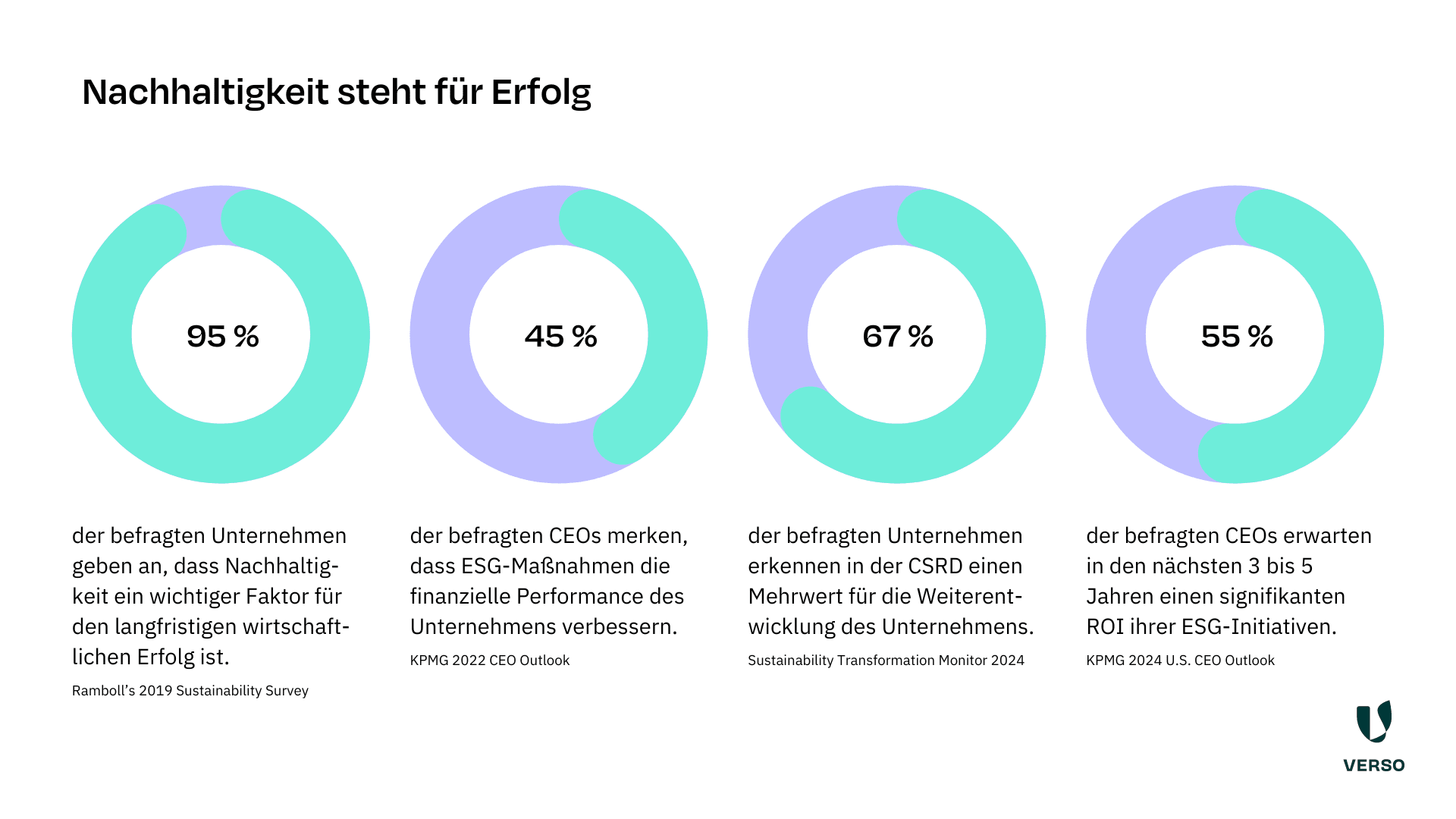

Developing an effective sustainability strategy makes companies fit for the future and secures competitive advantages. This guide shows you step by step how to create a long-term plan for the future with social and environmental practices.

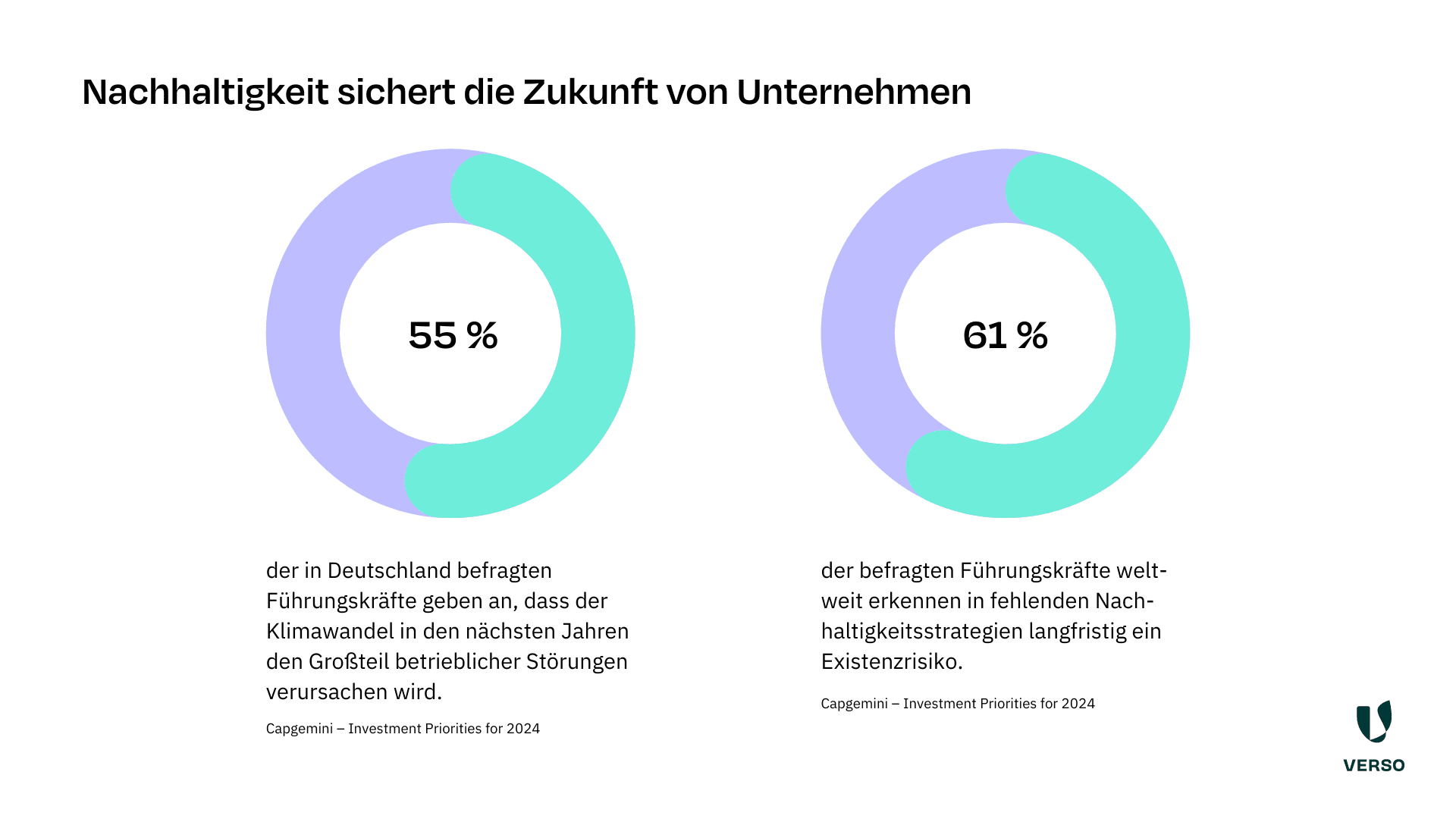

Developing a sustainability strategy is essential to make your company fit for the future.

The crucial point here is that you can tackle the key issues in a targeted and structured manner on the basis of the strategy.

In other words, minimize negative impacts, drive positive developments, reduce risks and seize opportunities.

This results in 5 clear advantages for your company:

- Competitive advantages

- Strategic planning

- Better image

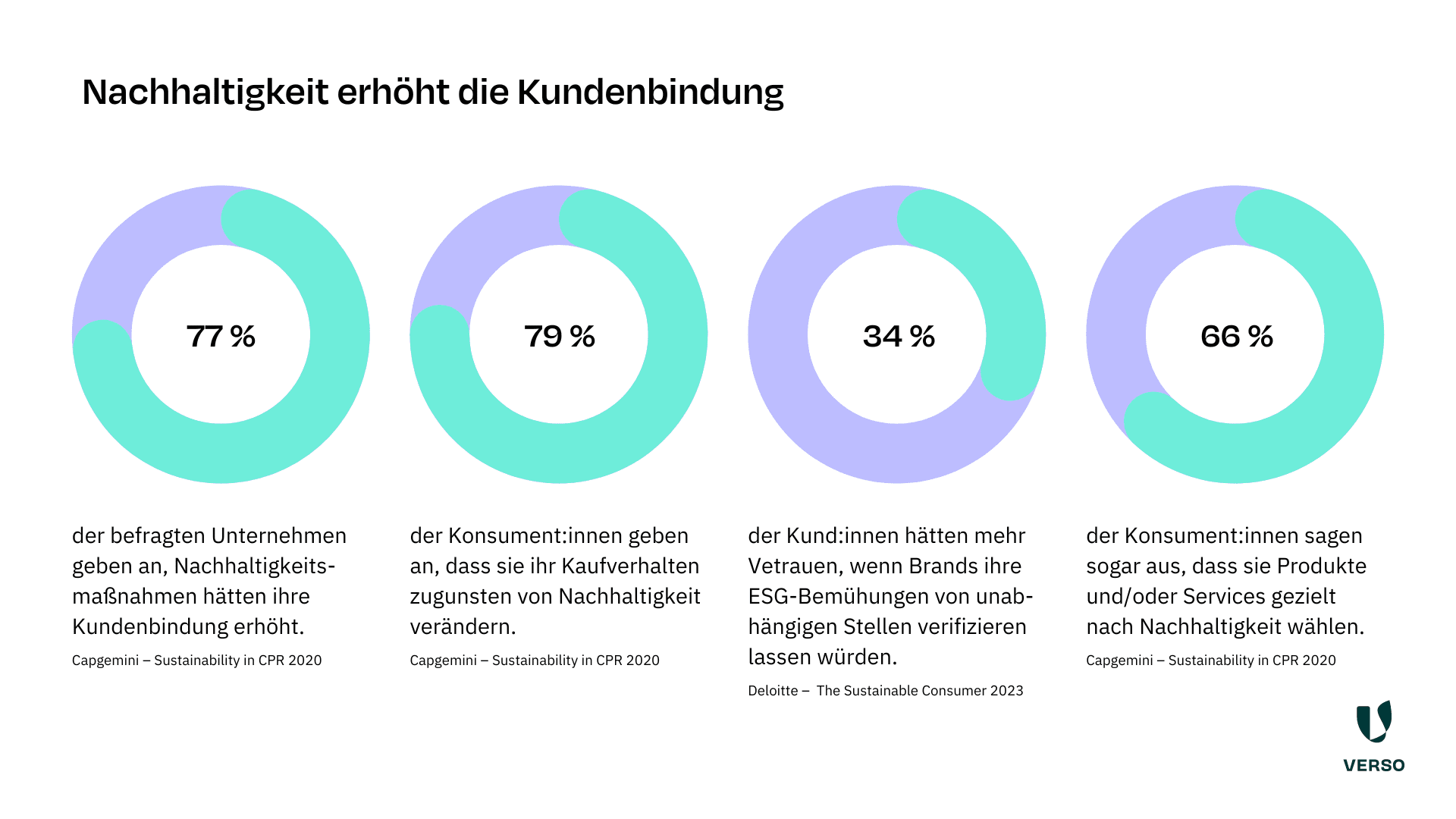

- Greater customer loyalty

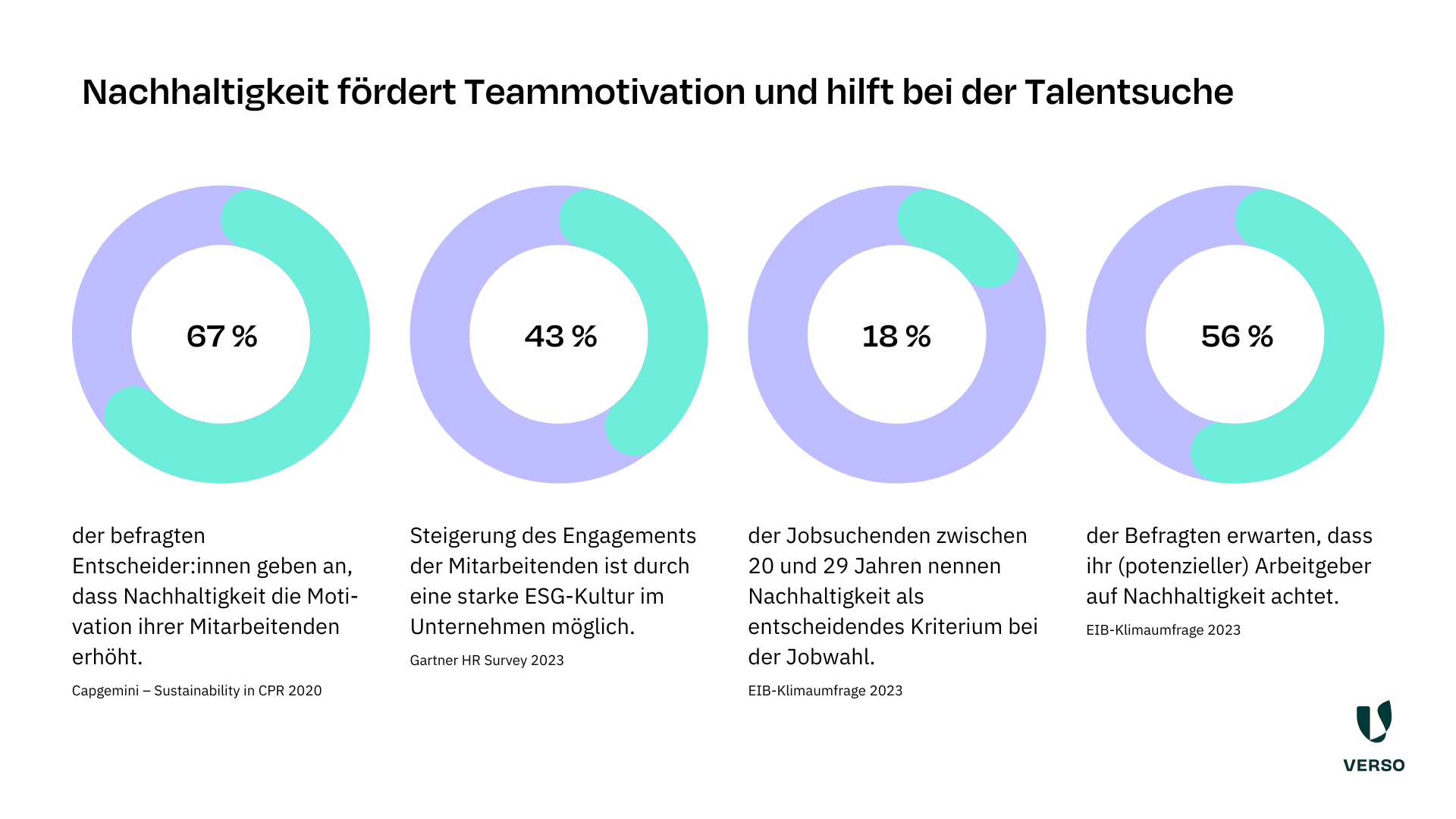

- Greater attractiveness for talent

We present these benefits to you in more detail in the blog post “5 reasons for a sustainability strategy“.

Now we want to show you how to develop an effective sustainability strategy step by step.

We want to dive deeper into the development of such a roadmap for the sustainable transformation of your company.

This guide will take you through the entire process.

We look at how you can

- Identify key issues,

- Define suitable measures and goals

- and ultimately arrive at an effective strategy.

This gives you a holistic focus on ESG issues and the implementation of environmental, social and governance aspects.

How do I develop a sustainability strategy for my company?

“Lack of concrete goals and KPIs” – this is one of the biggest obstacles to sustainable transformation in companies, as the Bertelsmann Stiftung’s Sustainability Transformation Monitor 2024 shows.

The lack of resources – both monetary and human – also plays a major role.

A sustainability strategy provides the solution here.

It contains concrete goals and key figures to monitor progress.

And it focuses on the most important issues so that human resources can be deployed efficiently.

However, there are other important steps in the development of an effective ESG strategy, which we will now take a closer look at.

1. status quo and key topics

To know where you want to go, you first need to know where you stand.

This is also the case when you are developing your sustainability strategy.

You determine the current state of your company using a status quo analysis.

This is your first data collection in the ESG area, so to speak, and should therefore be carried out thoroughly.

The data and information form the basis for your future sustainability efforts.

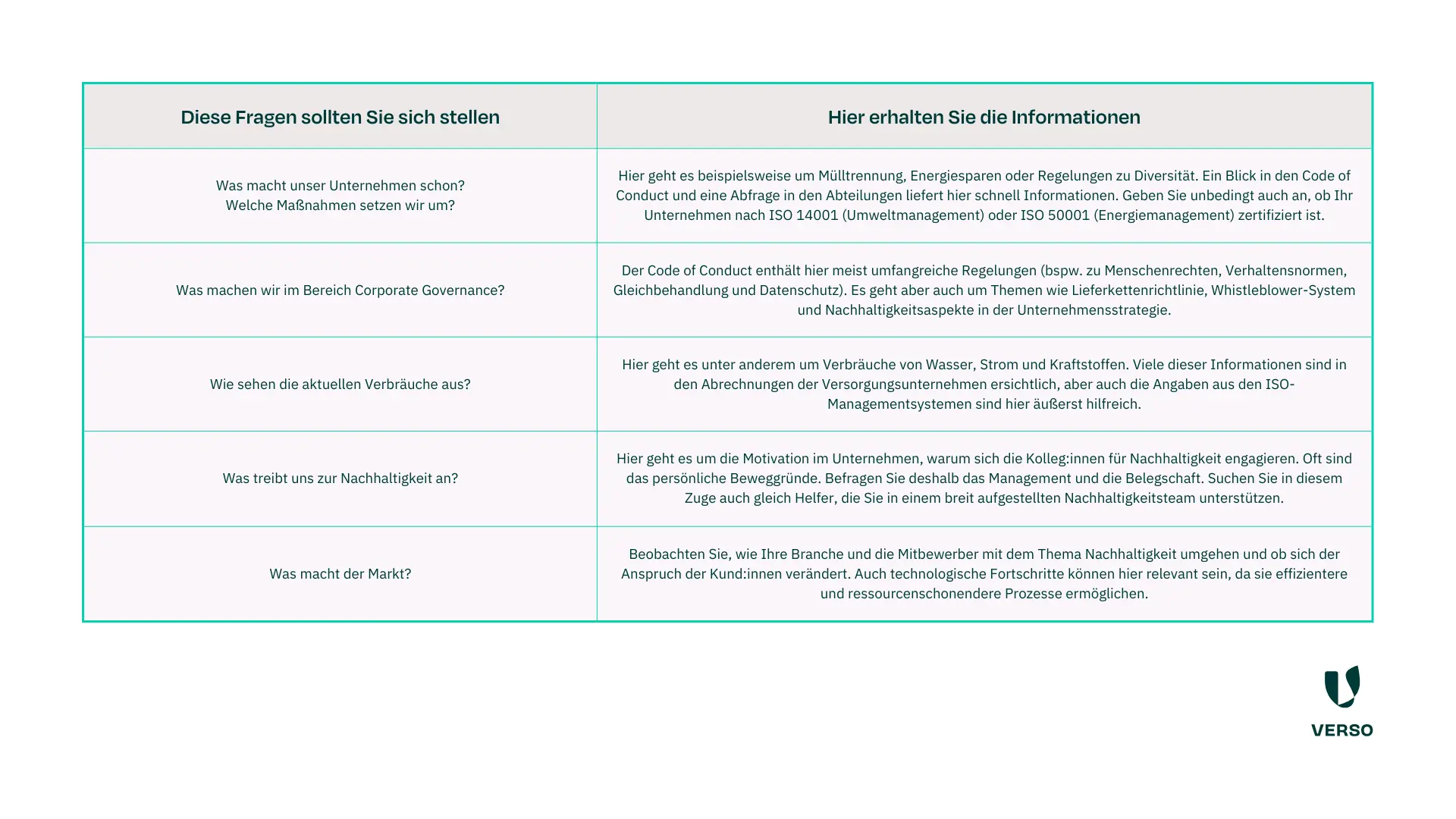

These topics, among others, play a role in determining the status quo:

The first time, the status quo analysis usually involves a great deal of effort.

Numerous departments have to be involved.

In some cases, the data is not available in the required form or has not yet been collected.

The VERSO ESG Hub simplifies and optimizes data management, as it is aligned with the ESG requirements of standards such as ESRS, GRI and DNK.

The analysis of the current status serves as the basis for the following materiality analysis.

Here you determine which sustainability issues are most important and where the greatest impacts, risks and opportunities (IRO) lie.

If you publish a sustainability report in accordance with CSRD, you must carry out a double materiality analysis here.

A simple materiality analysis is also sufficient for a DNK report.

Both procedures involve a certain amount of effort – the VERSO Sustainability Experts are therefore available to support you.

The results of the materiality analysis are your fields of action and the specific IROs.

2. define SMART objectives and suitable measures

Based on the key topics, you define targets and KPIs for monitoring as well as suitable measures to achieve the targets set.

You are at the center, so to speak, when you develop a sustainability strategy.

When defining objectives, rely on science-based support.

For example, use the GHG Protocol (Greenhouse Gas Protocol) or projects within the framework of the Paris Climate Agreement as a guide.

You can find industry-specific assistance from the Science Based Targets Initiative (SBTi), for example.

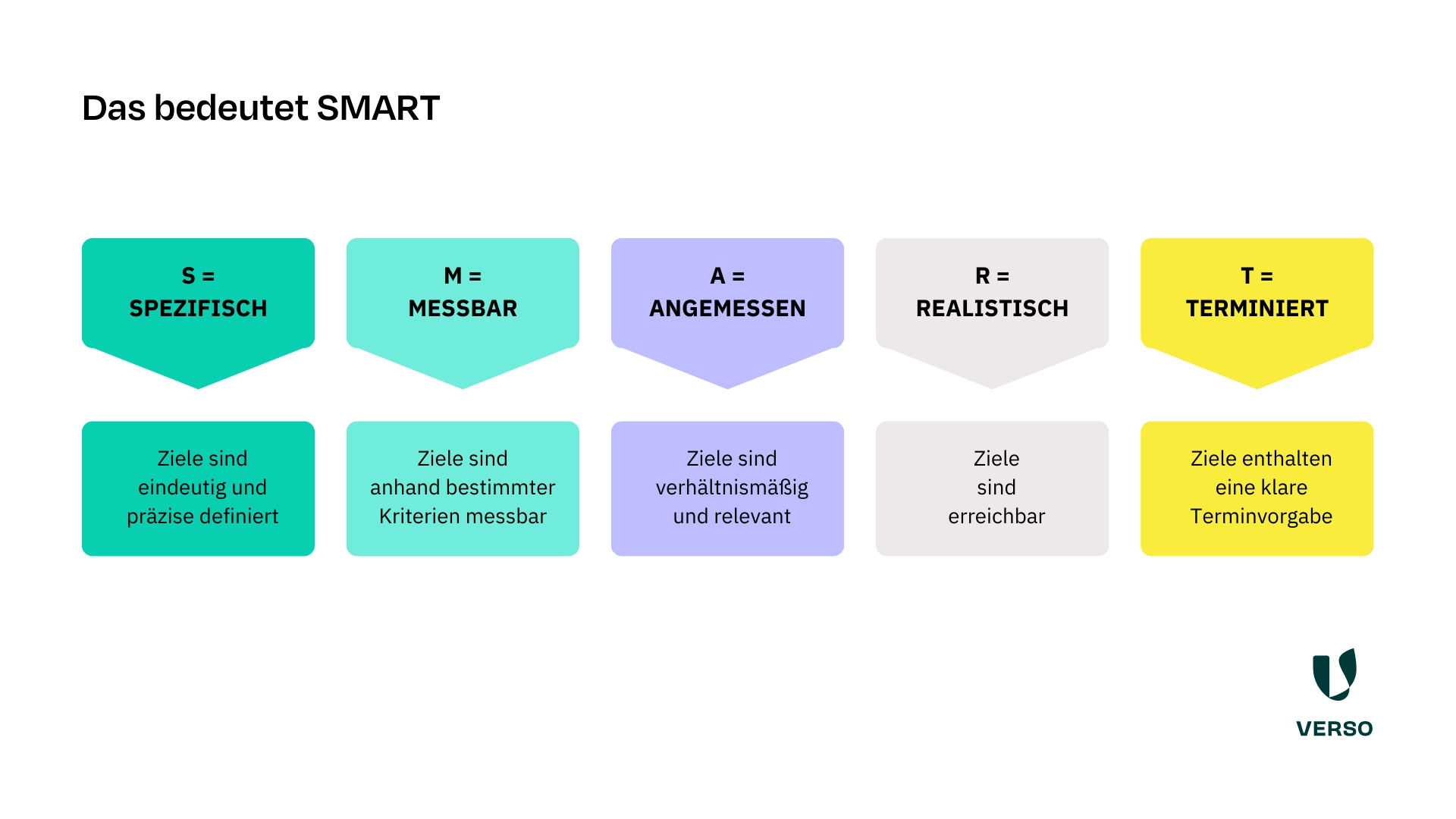

Make sure that you set yourself SMART targets.

This method originates from project management.

SMART is the acronym for Specific, Measurable, Achievable, Reasonable, Time-bound.

The goals in the area of sustainability should not be detached from the corporate goals.

Otherwise, conflicts of objectives can quickly arise.

Instead, it is a good idea to integrate your ESG goals into the overall strategy.

After the objectives, the headache continues – now it’s a question of what measures you want to use to achieve these objectives.

Involve your employees, but also other stakeholders and experts.

They are more likely to recognize solutions as they are more directly affected by the problems.

Be aware that not all measures can be implemented company-wide.

For some, it makes sense to implement them throughout the entire company.

However, other measures are more specific and are only suitable for a particular department.

You should formulate such measures directly with the employees concerned.

3. create an awareness of sustainability throughout the company

Sustainability is a company-wide team project.

All departments are needed, for example, to implement measures, define new targets and provide data for ESG reporting.

For this reason, it is also important to create a shared awareness of sustainability.

The best time to build this is when you are developing your sustainability strategy.

With a vision and mission for the sustainability area, you can give the topic the necessary importance.

These questions will help you to develop a meaningful statement that evokes emotions and motivates your employees:

- What is our vision of the future?

- What do we want to achieve as a company?

- What future do we see for our company?

- What values do we have as a company?

To give sustainability the importance it deserves in your company, you should not see it as a separate strategy.

Instead, integrate the topic into the overall strategy.

This will allow you to anchor the ambition to lead your company into a more sustainable future in all areas and processes of the company.

And very importantly: talk about your company’s ambitions.

Get everyone on board.

Communicate the vision and mission.

Explain what drives you and what you want to achieve.

This will create a shared awareness of sustainability.

4. it’s time for implementation: control is the be-all and end-all

The development of your sustainability strategy is complete – now it’s time to implement it.

You should see ESG management as a process.

It will take many years until you achieve your medium and long-term goals.

You need to take a long breath.

You will probably even have to adjust your measures and targets as new findings and developments (regulations, products, business models) emerge over time.

By constantly reviewing and measuring your measures using suitable KPIs, you can keep control of your progress and the entire process at all times.

Deviations from the target become apparent at an early stage and you can make adjustments.

A tool such as the VERSO ESG Hub is also ideally suited to this challenge and simplifies your sustainability management enormously.

Transparency is also an important factor during implementation in order to further increase awareness of sustainability among stakeholders and employees in particular.

Motivation is quickly diminished if you are only involved at the start but then hear nothing more about the topic.

It is therefore also important to talk openly about the results to date – both negative and positive.

This promotes trust and understanding, increases motivation and facilitates collaboration.

Develop a sustainability strategy: VERSO supports you!

VERSO supports you with expertise and software in the strategic implementation of sustainability in your company.

Our VERSO Sustainability Experts will accompany you throughout the entire process – from stocktaking and materiality analysis to sustainability management and reporting.

The VERSO ESG Hub offers you a comprehensive solution for holistic sustainability management.

And if you want to acquire further knowledge, you can attend training courses at the VERSO Academy.

This allows you to implement your sustainability strategy independently – but still receive reliable support.

Does that sound like what you’re looking for?

Feel free to contact us for more information.

* This information is summarized editorial content and should not be construed as legal advice. VERSO accepts no liability.

This might also interest you:

Subscribe to our newsletter!

Sign up and receive regular news about:

- Pragmatic all-in-one solution for ESG reporting, climate and supply chain management

- Individual advice from the VERSO experts

- Developed with expertise from 12+ years of sustainability management

- Trusted by 250+ customers