Phase-in regulations of the ESRS: All about the transition periods for the CSRD report

Companies that have to prepare a CSRD sustainability report are given some relief with the phase-in regulations of the ESRS. The transitional periods make it possible to address certain topics at a later date. In this article, you will find out which phase-in regulations and deadlines are available.

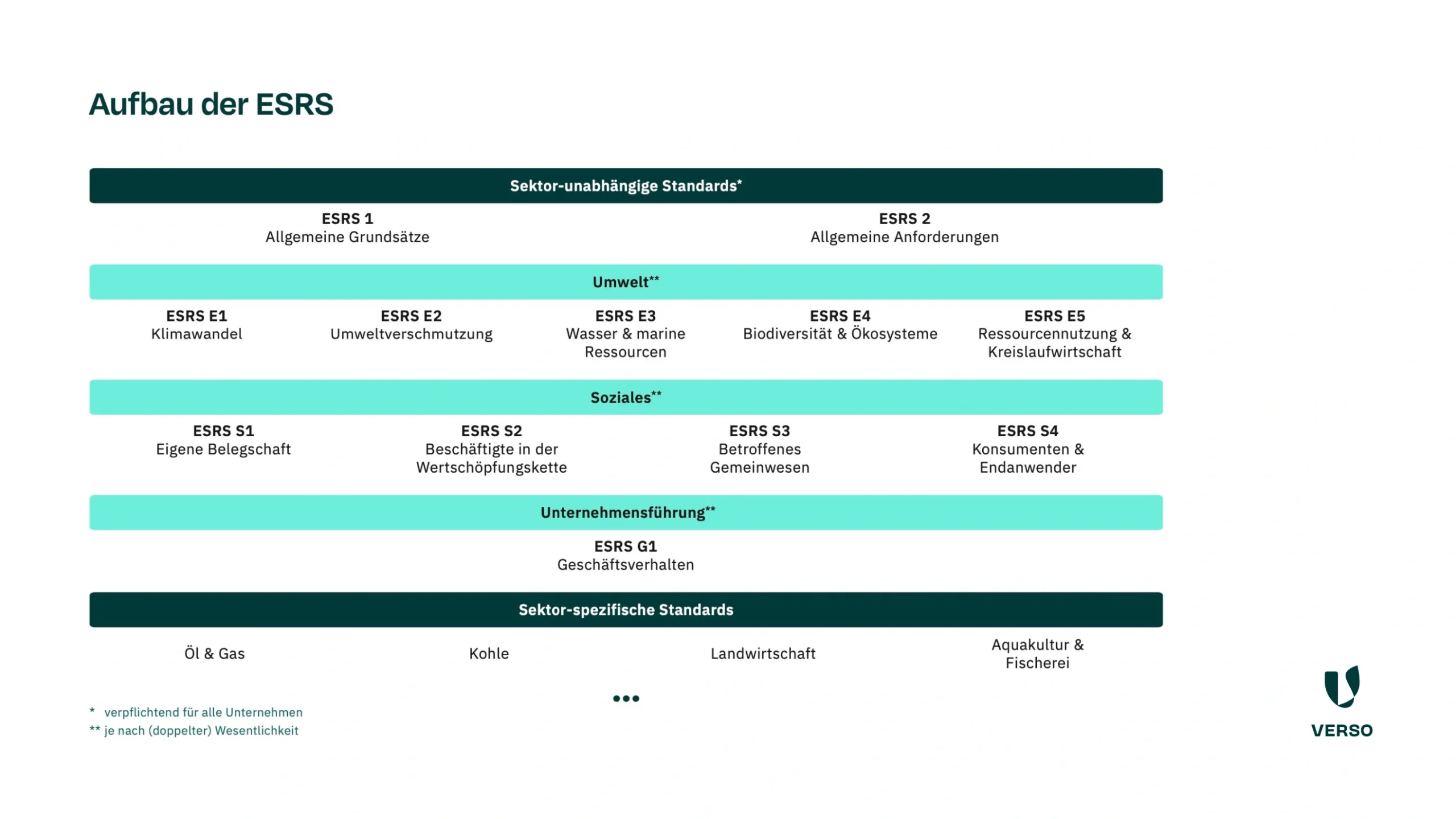

The European Sustainability Reporting Standards (ESRS) are the basis for a legally compliant sustainability report. However, the framework entails a large number of disclosure obligations. Companies must provide comprehensive qualitative and quantitative data on their material topics and data points. The path to a CSRD report is not easy! In order to provide some relief for companies subject to reporting requirements, the ESRS offer so-called phase-in regulations. The transitional periods allow you to process certain topics later or in a simplified form, even if you have identified them as material.

Why are there phase-in rules in the ESRS?

Plain and simple: for many companies, the data for some data points is simply not yet available. As data collection will still take some time, phase-in rules have been integrated into the ESRS. The transitional periods are intended to make the start of reporting a little easier. During this “acclimatization period”, companies can omit specific disclosure obligations, particularly in the first few years of mandatory reporting. The transition periods give you the opportunity to gradually build up the processes for data collection and CSRD reporting. Our tip is: start the reporting process as early as possible! And before your company is obliged to do so! This will allow you to establish and optimize important structures and processes before time runs out or it is even too late. Then you will be prepared when it comes to mandatory reporting or when the transition periods end and you have to provide all data on key topics.

What phase-in rules are there for the ESRS?

The ESRS offer companies numerous phase-in regulations. They are listed in Appendix C of ESRS 1. The scope varies greatly: sometimes they only relate to a few data points, sometimes to all disclosure requirements of a standard. When using the VERSO ESG Hub, the specific phase-in rules of the individual standards are displayed directly. You can therefore see at a glance whether you can omit a standard or have to report on it directly. In this list you will find the disclosure requirements that have been gradually introduced. The effective date refers to the mandatory reporting in each case.

| ESRS | Disclosure obligation | Transition period for companies under 750 employees |

Transition period for companies over 750 employees |

|---|---|---|---|

| ESRS 2 | SBM-1: Strategy, business model and value chain | The data points SBM-1, 40 b (Breakdown of total revenue by material ESRS sectors) and SBM-1, 40 c (List of additional relevant ESRS sectors) do not have to be reported until the delegated acts of the corresponding sector standards enter into force. | |

| SBM-3: Significant impacts, risks and opportunities and their interaction with strategy and business model | The data point SBM-3, 48 e (expected financial impact) can be omitted in the first year. In addition, qualitative data is sufficient in the first three years if it is not feasible to prepare quantitative data. | ||

| ESRS | Disclosure obligation | Transition period for companies under 750 employees |

Transition period for companies over 750 employees |

| ESRS E1 | E1-6: Gross greenhouse gas emissions (Scope 1, 2, 3 and total greenhouse gas emissions) | Information on Scope 3 and total emissions can be omitted in the first year if the company has fewer than 750 employees on average. | — |

| E1-9: Expected financial impact of significant physical and transition risks and potential climate-related opportunities | The information can be omitted in the first year. In addition, qualitative data is sufficient in the first three years if it is not feasible to prepare quantitative data. | ||

| ESRS E2 | E2-6: Expected financial impact due to pollution-related impacts, risks and opportunities | The information can be omitted in the first year. In addition, qualitative information is sufficient in the first three years. An exception to this second simplification is data point E2, 40 b on operating and capital expenditure incurred in the reporting period in connection with major incidents and deposits. | |

| ESRS E3 | E3-5: Expected financial implications of impacts, risks and opportunities related to water and marine resources | The information can be omitted in the first year. In addition, qualitative information is sufficient in the first three years. | |

| ESRS E4 | E4: All disclosure requirements | The disclosures can be omitted in the first two years if the company has an average of less than 750 employees. | — |

| E4-6: Expected financial implications of impacts, risks and opportunities related to biodiversity and ecosystems | The information can be omitted in the first year. In addition, qualitative information is sufficient in the first three years. | ||

| ESRS E5 | E5-6: Expected financial implications related to resource use and circular economy impacts, risks and opportunities | The information can be omitted in the first year. In addition, qualitative information is sufficient in the first three years. | |

| ESRS | Disclosure obligation | Transition period for companies under 750 employees |

Transition period for companies over 750 employees |

| ESRS S1 | S1: All disclosure requirements | The disclosures can be omitted in the first year if the company has an average of less than 750 employees. | — |

| S1-7: Characteristics of the company’s external workforce | The information can be omitted in the first year. | ||

| S1-8: Collective bargaining coverage and social dialog | The disclosure requirement in relation to own workforce in non-EEA countries can be omitted in the first year. | ||

| S1-11: Social security | The information can be omitted in the first year. | ||

| S1-12: Percentage of people with disabilities | The data can be omitted in the first year. | ||

| S1-13: Continuing education and skills development | The information can be omitted in the first year. | ||

| S1-14: Health and safety | Information on the data points on work-related illnesses and the number of days lost due to injuries, accidents, fatalities and work-related illnesses can be omitted in the first year. In addition, reporting on external workers may be omitted. | ||

| S1-15: Work-life balance | The information can be omitted in the first year. | ||

| ESRS S2 | S2: All disclosure requirements | The disclosures can be omitted in the first two years if the company has an average of less than 750 employees. | — |

| ESRS S3 | S3: All disclosure requirements | The disclosures can be omitted in the first two years if the company has an average of less than 750 employees. | — |

| ESRS S4 | S4: All disclosure requirements | The disclosures can be omitted in the first two years if the company has an average of less than 750 employees. | — |

Phase-in rules: The key to successful ESRS reporting

The ESRS phase-in rules are a useful relief for companies preparing for CSRD reporting. However, they should not be a free ride, but a strategic opportunity to prepare for the new requirements. Companies should use the transition periods to set up internal processes and create the data basis for future reports. The sooner you start, the better prepared you will be for the full implementation of the CSRD requirements. Although reporting in accordance with the ESRS is challenging, it is also an opportunity to embed sustainable business practices deep within the company. In the long term, this not only pays off in terms of regulatory compliance, but also creates valuable opportunities for your business. In a blog post, we show 6 potentials of CSRD for your company.

Get to know the VERSO ESG Hub right away

The VERSO ESG Hub simplifies and accelerates the entire CSRD reporting process. Would you like to get to know the software solution right away? Then arrange a demo appointment directly.

* This information is summarized editorial content and should not be construed as legal advice. VERSO accepts no liability.

This might also interest you:

Subscribe to our newsletter!

Sign up and receive regular news about:

- Current ESG topics and legislative changes

- Individual advice from the VERSO experts

- News about VERSO

- Trusted by 250+ customers