Sustainability Report – What Is It and What Do You Need to Know?

Some companies are intrinsically motivated to embed ESG within their organization, while others are driven by the CSRD requirements or aim to gain a competitive edge. For all of them, the sustainability report becomes a constant companion on their ESG journey. Here’s an overview of the key terms and requirements for reporting.

What is a sustainability report?

This is the first fundamental question to address. In their sustainability report, companies disclose information on:

- Environmental aspects,

- Social matters

- Corporate governance

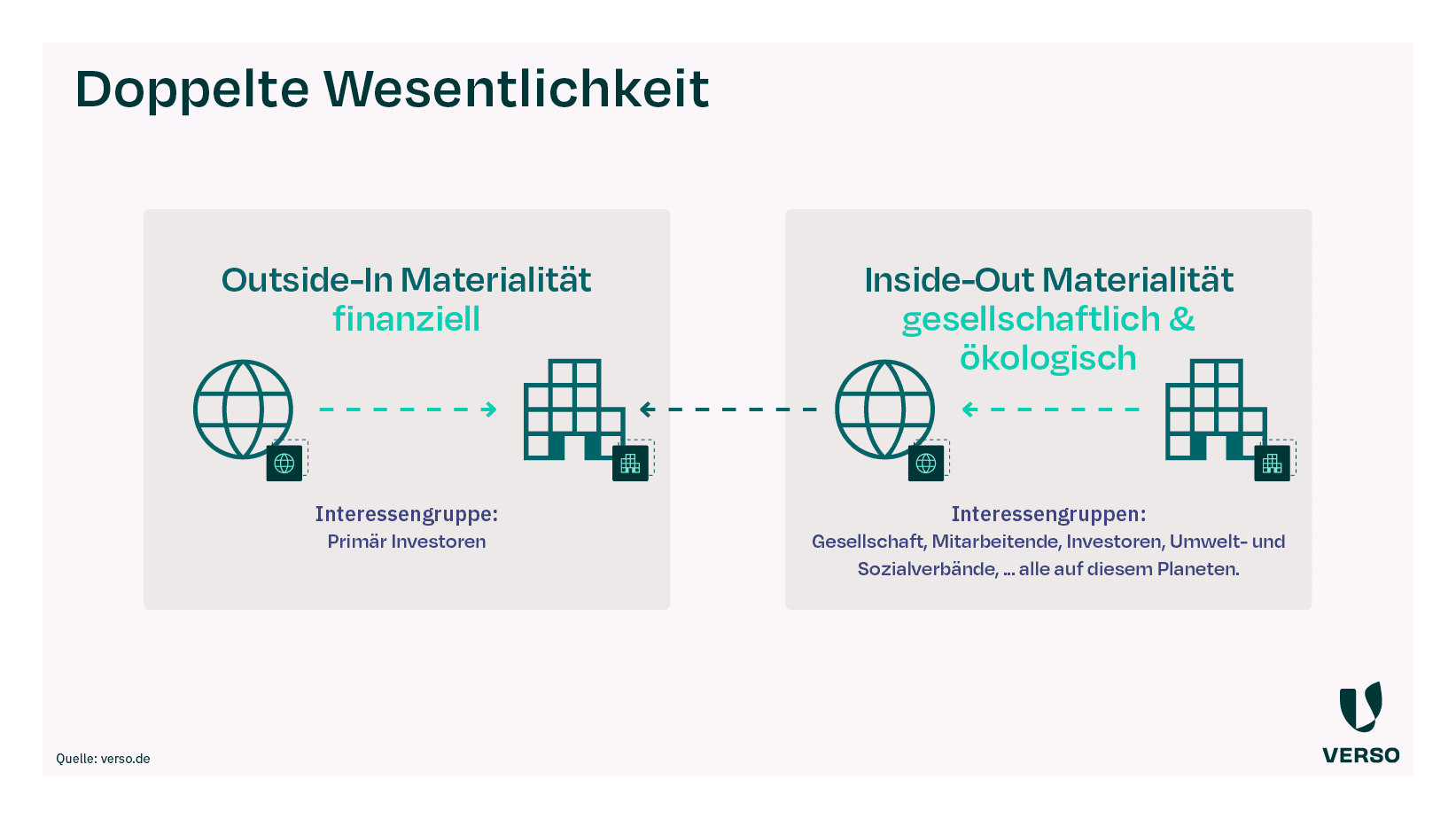

The report outlines how external factors impact the company and how the company’s activities affect the environment and society. The first report usually reflects the status quo. However, the report is meant to go beyond that: it also describes strategies, targets, and actions aimed at enhancing sustainability.

The length, structure, and thematic focus of sustainability reports can vary greatly. This depends on the standard you choose. In general, you are free to decide which reporting framework to follow—unless you are bound to mandatory reporting requirements, such as those under the CSRD. In that case, you must comply with specific guidelines and often follow certain standards, such as the ESRS.

Sustainability, ESG, CSR – What’s the difference?

When it comes to reporting, all three terms essentially refer to the same concept: addressing the fundamental responsibility of companies toward the environment and society—now and in the future.

In recent years, the term CSR (Corporate Social Responsibility) was widely used in Germany.

- CSR describes a company’s responsibility for its impact on society.

- In practice, the term was often used to cover all three dimensions of sustainability: environmental, social, and governance aspects.

- The focus of CSR is more on the qualitative assessment of a company’s actions regarding sustainability, corporate values, and social engagement.

The term ESG has now become increasingly established.

- ESG stands for Environmental, Social, and Governance.

- The term originates from the financial sector and focuses primarily on assessing companies based on environmental, social, and governance factors.

- Measuring sustainability follows a more quantitative approach.

The broader term sustainability is generally used synonymously with CSR and ESG. It also accurately describes the reporting process, as it covers sustainability across all areas of the business.

You can find more on this topic in our blog post “CSR, ESG, Sustainability – What’s the Difference?”.

When do I have to publish my first sustainability report?

With the new Corporate Sustainability Reporting Directive (CSRD), many companies in Germany will soon be required to publish a sustainability report. The reporting obligation is based on criteria such as the number of employees, revenue, and total assets.

Although the first report often requires significant effort and may contain only limited insights into progress and developments, our honest advice is: Start now!

Our CSRD factsheet helps you quickly find out if and when your company is subject to reporting requirements—and what your next steps should be.

How do I create a sustainability report?

The first sustainability report can be demanding. You’re likely doing this for the very first time, with little prior experience—targeted training, such as in the VERSO Academy, can be a great help. You often have no benchmarks yet, no established processes or structures, and still need to find the right reporting software—based on our experience with customers, the list of challenges for a first report is long.

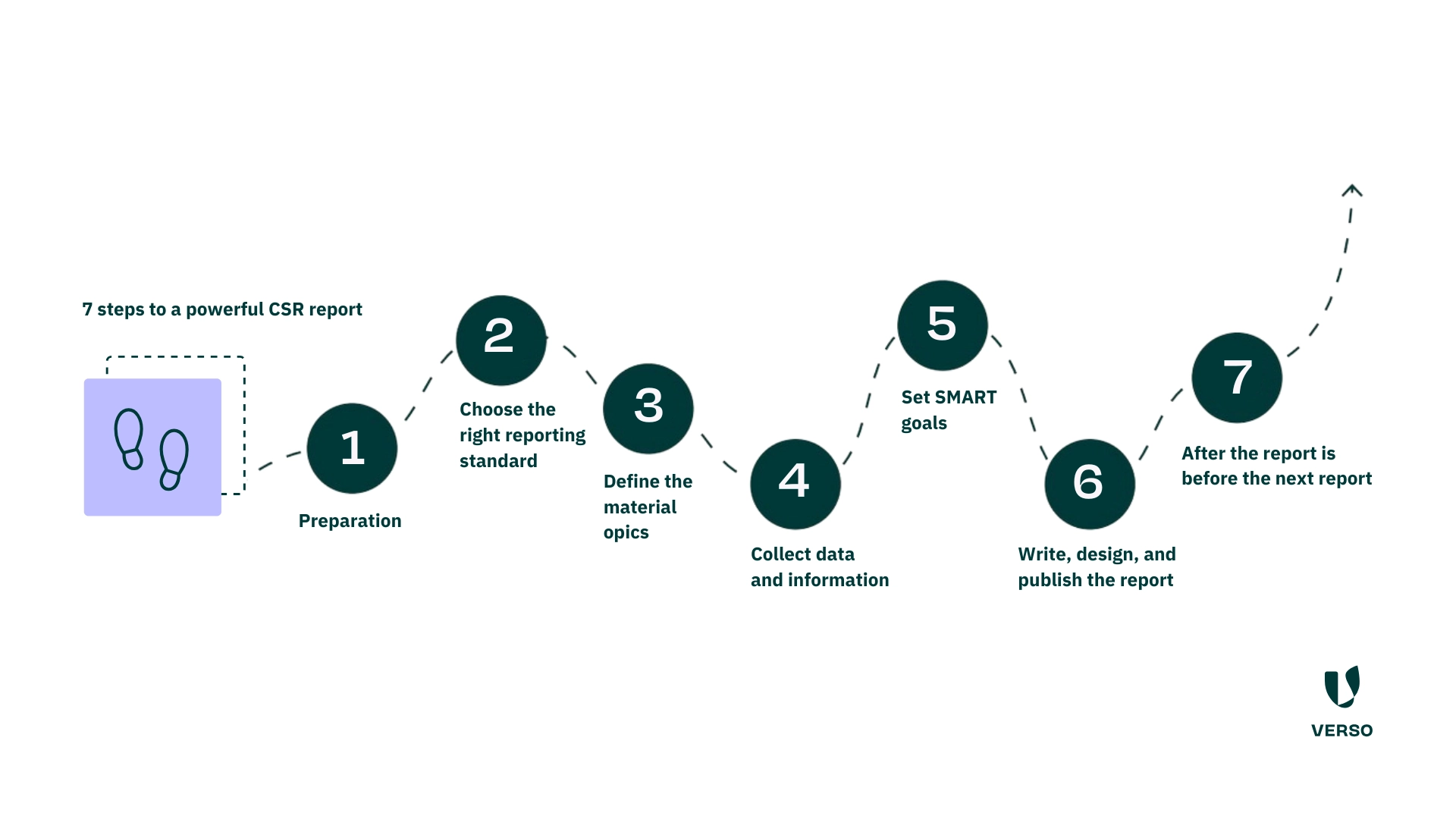

That’s where we come in: With the VERSO ESG Hub, you can create your sustainability report easily and efficiently. To help you get started, we’ve created a hands-on guide “7 Steps to Your CSR Report” that walks you through the process step by step toward a meaningful sustainability report.

For CSRD beginners, we’ve also developed a 10-step guide for your CSRD report and share our tips for efficient data collection. And when it comes to software, you can rely on VERSO for your CSRD reporting: our CSRD Suite offers you an all-in-one solution.

I’m new to the role of ESG Manager:r…

How do I establish sustainability management in my company?

If you’re just starting to work with ESG, this may sound familiar: You have a lot of ideas and initiatives in mind, but you need to align them within a clear, goal-oriented sustainability strategy. You’re also thinking about which targets are realistic and make sense for your business. On top of that, you still need the right processes and metrics to monitor progress.

And above all, three key questions arise:

- What does all of this mean for my company?

- How do I tackle such a huge topic?

- How do I justify my efforts and the necessary resources to management?

Our introductory blog articles on sustainability management are a great starting point. You’ll gain valuable insights into your role and responsibilities as a sustainability manager and get tips on how to communicate effectively with management – showing why sustainability matters for your business.

CSRD, SFDR, EU Taxonomy – What are they, and what’s the background?

With so many regulations, you’ve probably come across terms like CSRD, SFDR, EU Taxonomy, and ESRS. They are all part of the European Green Deal and closely interconnected. The EU aims to strengthen sustainability across the economy through these directives and regulations.

To comply with the CSRD, companies are required to report according to the ESRS—the European standards set by the EU. But how exactly do you apply these standards? Do frameworks like GRI or DNK also meet these requirements? You’ll find the answers in our ESRS Whitepaper.

The SFDR is a sustainability-related disclosure regulation for the financial sector. If you’re unsure whether it applies to your business and what steps to take, our SFDR Factsheet provides the guidance you need.

The EU Taxonomy is a classification system applied within CSRD and SFDR. It defines when an economic activity is considered green, sustainable, or environmentally friendly—creating clarity around sustainability claims. What this classification means for your business and your sustainability work is explained in our EU Taxonomy Whitepaper.

How can I make my company more sustainable?

Start taking action now! The more you can showcase (implemented) measures in your report, the more meaningful your sustainability report will be. Here are a few tips for effective sustainability initiatives in your company.

Communicate your sustainability journey right from the start—and be transparent about areas where action is still needed. This makes your ambitions credible and easier to understand. But be careful not to fall into common greenwashing traps when communicating your efforts. Not only could this damage your reputation, but the EU is also introducing specific anti-greenwashing regulations, such as the Green Claims Directive.

We support you in creating your sustainability report!

Preparing a sustainability report is especially challenging the first time. But with the right tools and solid knowledge, you can save both time and costs. We offer the perfect solution for both: Our training programs provide fresh insights and help you become a sustainability expert. And with our ESG management software, you can quickly and efficiently collect all relevant sustainability data in one place.

* This information is summarized editorial content and should not be considered legal advice. VERSO assumes no liability.

This might also interest you:

Subscribe to our newsletter!

Sign up and receive regular news about:

- Pragmatic all-in-one solution for ESG reporting, climate and supply chain management

- Best practices in the areas of ESG and sustainable supply chains

- Developed with expertise from 12+ years of sustainability management

- Sustainability events and much more.