CBAM – Carbon Border Adjustment Mechanism explained simply

The Carbon Border Adjustment Mechanism (CBAM) is part of the EU climate strategy and aims to price CO2 emissions beyond the EU. The CBAM brings new challenges for procurement and the supply chain. Read this article to find out what you can expect from the CBAM and how you can master it!

Getting started: What is CBAM?

CBAM (“Carbon Border Adjustment Mechanism”) is the official title of the new Regulation EU 2023/956. To understand the background to this regulation, it is best to go back to 2005. This was the year in which the European Emissions Trading Scheme (EU ETS) was introduced; the European instrument for implementing the Kyoto Protocol. In order to actually achieve the climate protection targets set, the EU has adapted the emissions trading system several times – most recently in 2021, as part of the Fit for 55 package. The EU ETS aims to limit emissions with a cap and trade system. An upper limit is set for the amount of emissions that companies are allowed to emit. If these are not sufficient, allowances can be purchased. This has been a problem in recent years. In order to avoid the strict EU requirements and the associated costs, some companies have relocated theirCO2-intensive production to countries with no or lowerCO2 prices. This phenomenon is also known as “carbon leakage ” or “relocation ofCO2 emissions“. The CBAM now wants to counteract this. After publication on August 17, 2023, the CBAM officially came into force on October 1, 2023. Anyone importing emission-intensive goods into the EU is now obliged to purchase offsetting CBAM certificates.

CBAM should…

- strengthen existing measures to reduce emissions,

- encourage companies to reduce their production emissions instead of relocating, and

- protect companies that continue to produce in the EU from cost-related competitive disadvantages

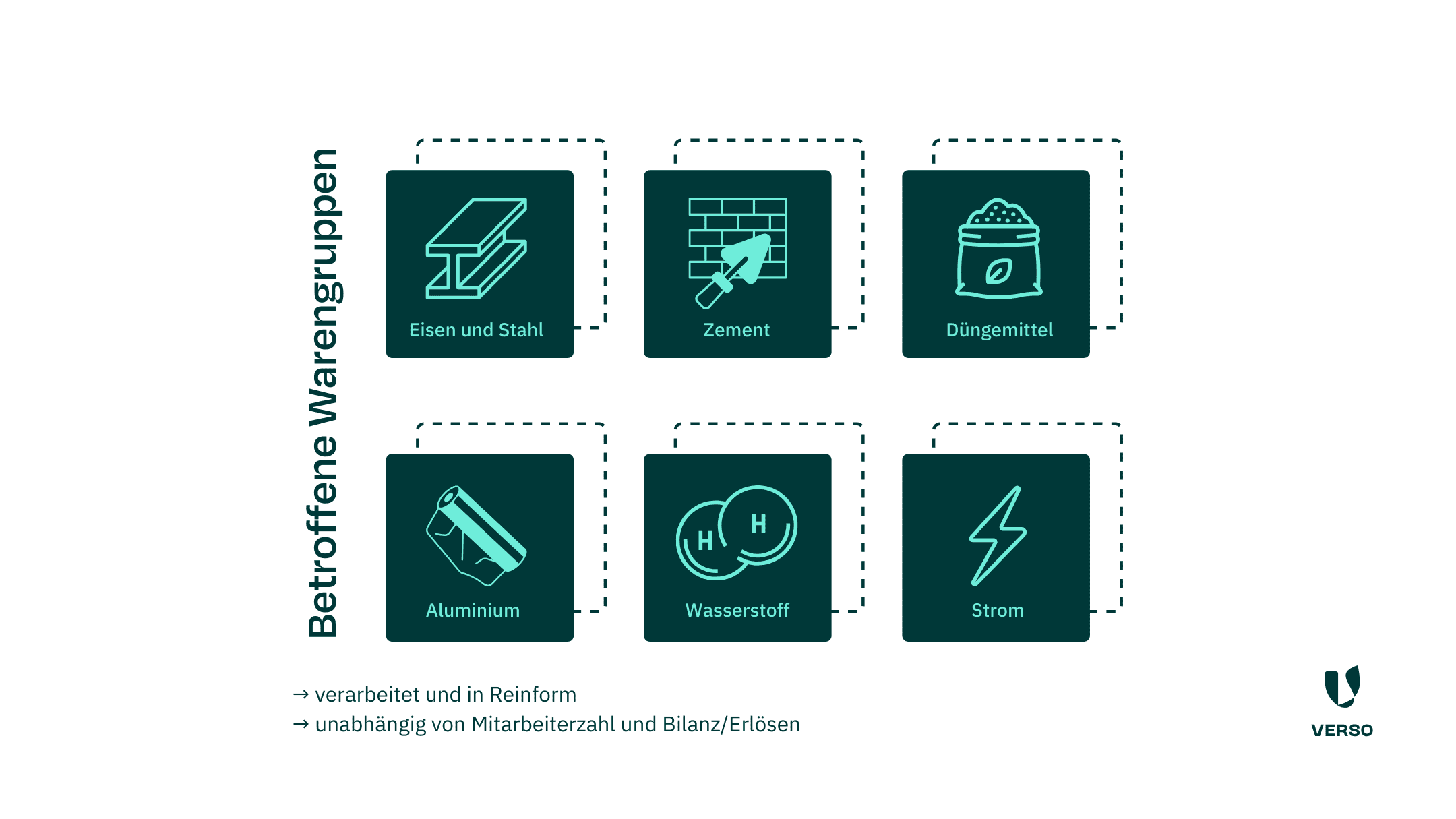

Which goods and companies are affected by the CBAM?

The CBAM initially affects all companies that import particularly emission-intensive product groups in pure or processed form from non-EU countries. The CBAM covers:

- Iron and steel

- Cement

- Fertilizer

- Aluminum

- Hydrogen

- Electricity

Annex I of the CBAM Regulation lists the CN codes concerned in detail – but you can also find them more simply in our compact CBAM factsheet.

The EU reserves the right to adapt regulations and product groups until 2026. The scope of application will therefore be extended in the future. By 2030, all products that are subject to EU emissions trading are to be included in the CBAM. The new regulations cover both direct production emissions and indirect emissions from the manufacture of preliminary products or the electricity required. In contrast to the recently introduced CSRD, theCO2 border adjustment mechanism does not differentiate between turnover and employee numbers. The new system is therefore mandatory for almost all companies in the manufacturing and production industry, provided they import from third countries

How does the CBAM work?

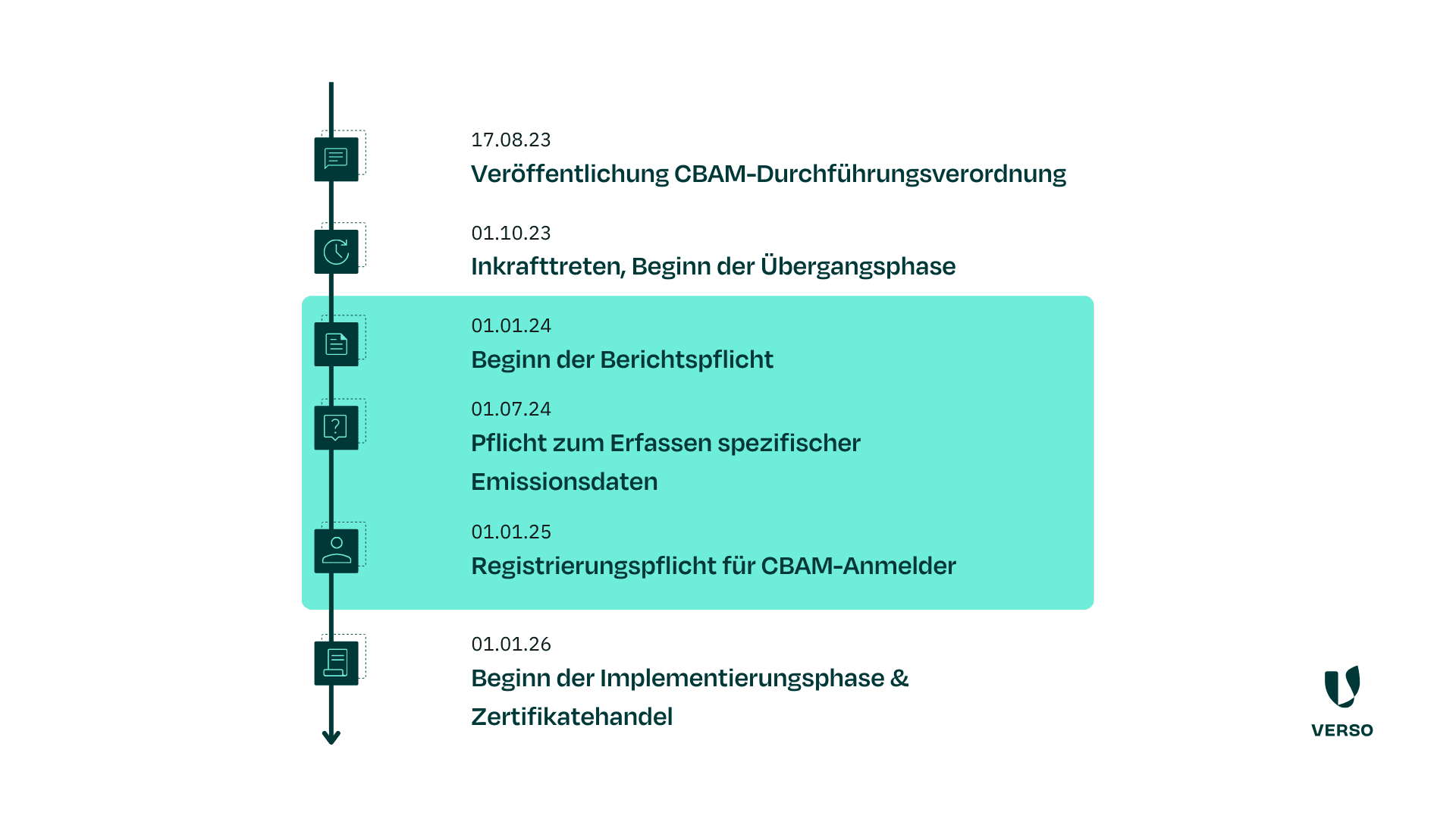

CBAM Regulation: Timetable

Let’s move on from theory to practice. After coming into force on October 1, 2023, a transitional period began. During this period, your company is only required to report and must prepare quarterly updated reports on the goods you import. Here is a brief overview of the CBAM timetable and the corresponding requirements:

- 08.2023: Publication of the CBAM Implementing Regulation

- 10.2023: Entry into force, start of the transition phase with quarterly reporting obligation for imported CBAM goods

- 01.2024: Start of the reporting obligation

- 07.2024: Obligation to record specific emissions data

- 01.2025: Registration obligation for CBAM applicants

- 01.2026: Start of implementation phase and certificate trading

This belongs in the CBAM report

Ab 01.10.2023 – Quarterly report, to be submitted by 1 month after the end of the quarter

- Master data of your company

- CBAM account number

- Number and type of imported goods

- CBAM-relevant greenhouse gas emissions (specific, no standard values!)

- CO2 offset price in the country of origin

From 31 May 2026 – annual CBAM declaration for the previous calendar year, from 2026

- Total quantity of imported goods

- Total amount of grey emissions for each product group

- Total number of CBAM allowances allocated to gray emissions – minus theCO2 price paid in the country of origin

Emissions offsetting obligation and CBAM certificate trading

From 01.01.2026, the following applies: All emissions that your company has not yet offset in the country of origin of your goods must now be offset via certificates. To do this, you first need a CBAM registration authorization for your company’s branch. Only “approved registrants” will be entitled to purchase certificates and import CBAM goods from 2026. You can then purchase unlimited certificates for your company on a central platform. The price of CBAM certificates is based on the weekly average price of EU ETS certificates. In principle, you should always have enough certificates available to offset at least 80 percent of your imported CBAM products. You must determine the necessary offset and the corresponding quantity of certificates yourself. CBAM certificates are valid for two years and can be surrendered.

FAQ about CBAM

Where do I submit my CBAM reports?

Declarants subject to reporting obligations initially submit their reports in the CBAM transitional register. You can access the register via the customs portal.

Does the CBAM provide for sanctions?

Yes, the CBAM Regulation provides for “proportionate and dissuasive sanctions” in the event of non-compliance. Penalties of 10 to 50 euros per non-reported tonneof CO2 emissions are already envisaged in the transition phase.

Read more in our article “Sanctions for errors in ESG reporting and implementation”.

Are there threshold values for the import of CBAM products?

Yes, the reporting obligation only applies to imports with a customs value of 150 euros or more per consignment. Apart from that, the CBAM applies independently.

Can I still use default values in the CBAM report?

Since 31 July 2024, companies subject to CBAM reporting requirements are no longer allowed to use default emission values. If you still do not have the real data – e.g. because your suppliers do not provide it – the German Emissions Trading Authority may allow default values under certain circumstances. Proceed as follows:

- Map your procedure for determining the real data

- Provide evidence of your efforts or justify in a comprehensible manner that you have made ‘all reasonable efforts’

- To do this, use the ‘Comments’ field in the CBAM transition tab

- There must be no other discrepancies in the submitted report – so take a close look!

What is the best way to implement the CBAM?

With the CBAM regulations, your company once again has a lot on its plate. What is intended to be a sensible and, above all, important step for the environment and the economy is in practice associated with a lot of bureaucracy and effort – especially when it comes to collecting all the necessary data. Close cooperation with your suppliers is essential here. With VERSO, you can avoid the data chaos and optimally prepare your supply chain for upcoming CBAM requirements: In the CBAM module of the Supply Chain Hub, you automatically and efficiently record all the data that the newCO2 border adjustment system requires of you – including proof of your efforts. Watch a free demo now to see how it works:

* This information is summarized editorial content and should not be construed as legal advice. VERSO accepts no liability.

This might also interest you:

Subscribe to our newsletter!

Register now to arrange a free demo appointment and get to know our solutions at first hand.

- Pragmatic all-in-one solution for ESG reporting, climate and supply chain management

- Best practices in the areas of ESG and sustainable supply chains

- Developed with expertise from 12+ years of sustainability management

- Sustainability events and much more.