CSRD und Arbeitskräfte: Tipps zum Reporting nach ESRS S1 und S2

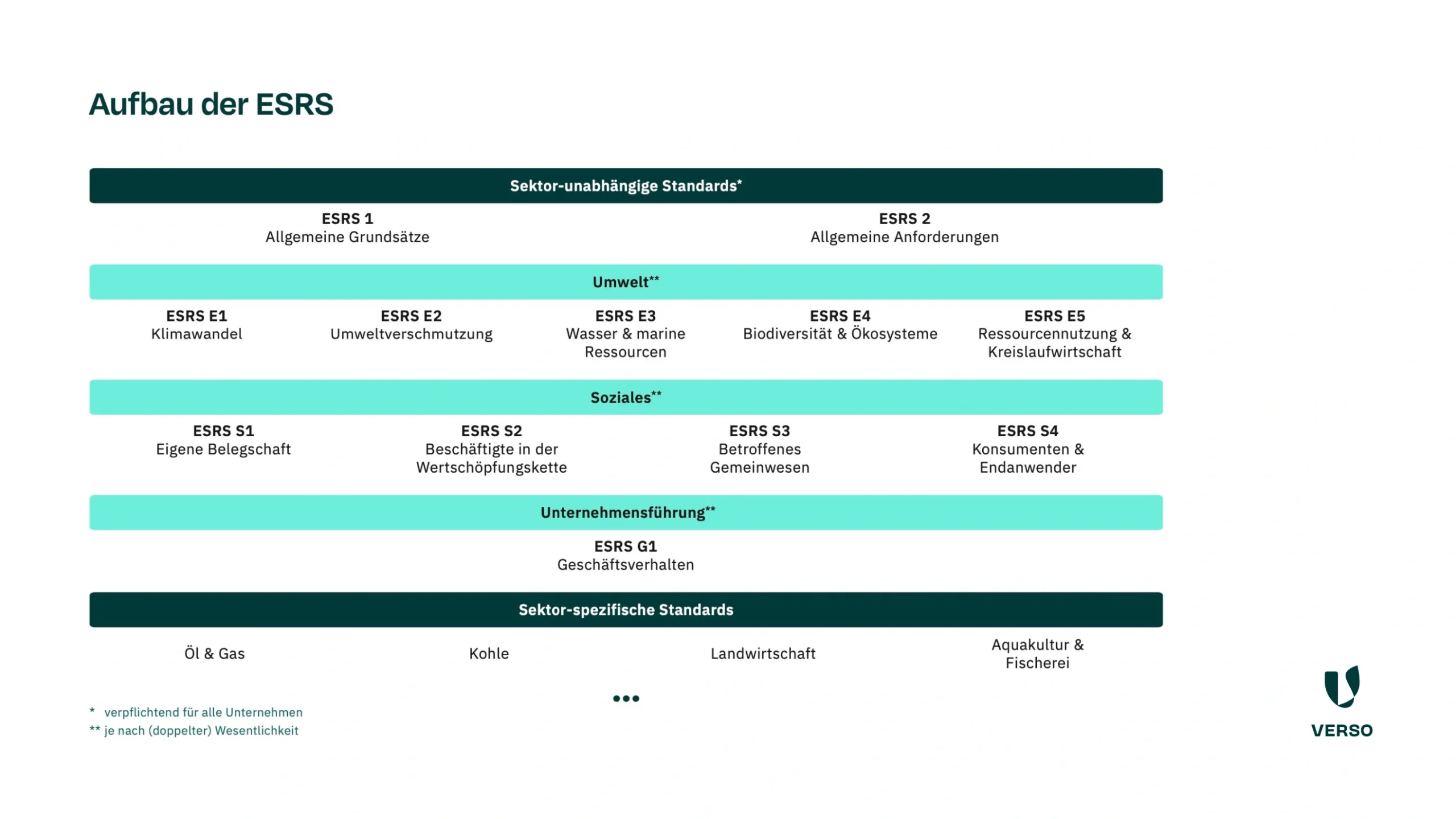

Die ESRS-Standards in Bezug auf Arbeitskräfte, ESRS S1 und S2, gehören zu den anspruchsvollsten im Rahmen der Berichterstattung nach CSRD. S1 betrifft die eigenen Mitarbeitenden und ist sehr umfangreich. S2 bezieht sich auf die Beschäftigten in der Wertschöpfungskette. In diesem Beitrag erklären wir, warum die Standards wichtig sind, welche Anforderungen an Unternehmen gestellt werden und wie Sie die erforderlichen Daten sammeln.

ESRS S1 und S2 – die Standards zu den Arbeitskräften

Die ESRS S1 und S2 nehmen im CSRD-Bericht eine bedeutende Rolle ein. Sie behandeln die Arbeitskräfte des Unternehmens (S1) und die Arbeitskräfte in der Wertschöpfungskette (S2). Dabei geht es unter anderem um Themen wie Arbeitsbedingungen, Rechte von Mitarbeitenden, Vielfalt und Inklusion, aber auch Kinder- und Zwangsarbeit.

Allein der Standard S1 ist im CSRD-Bericht ähnlich umfassend wie die Offenlegungspflichten im Bereich Klimaschutz. Hierzu haben wir ebenfalls Tipps zum Reporting nach ESRS E1.

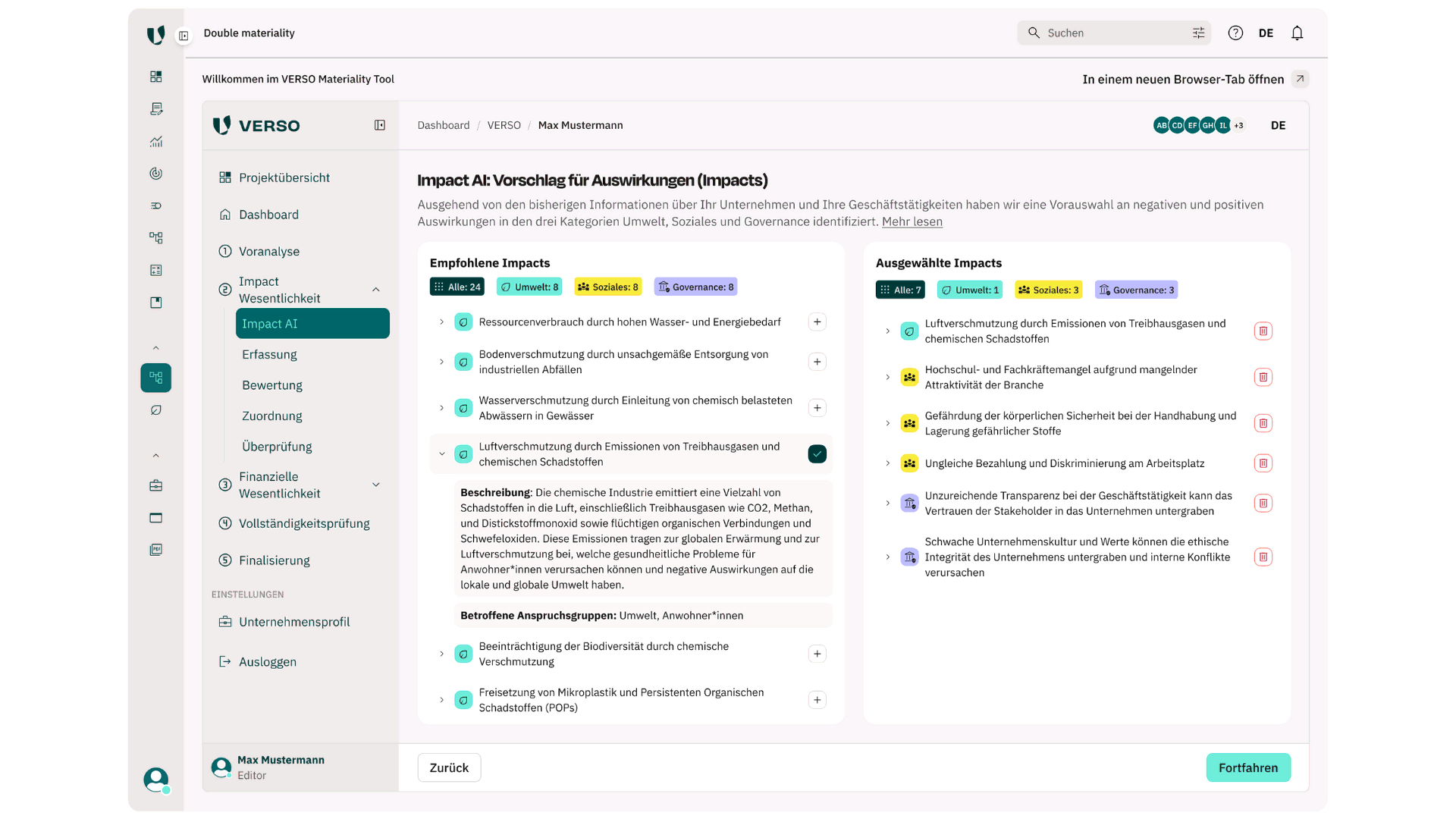

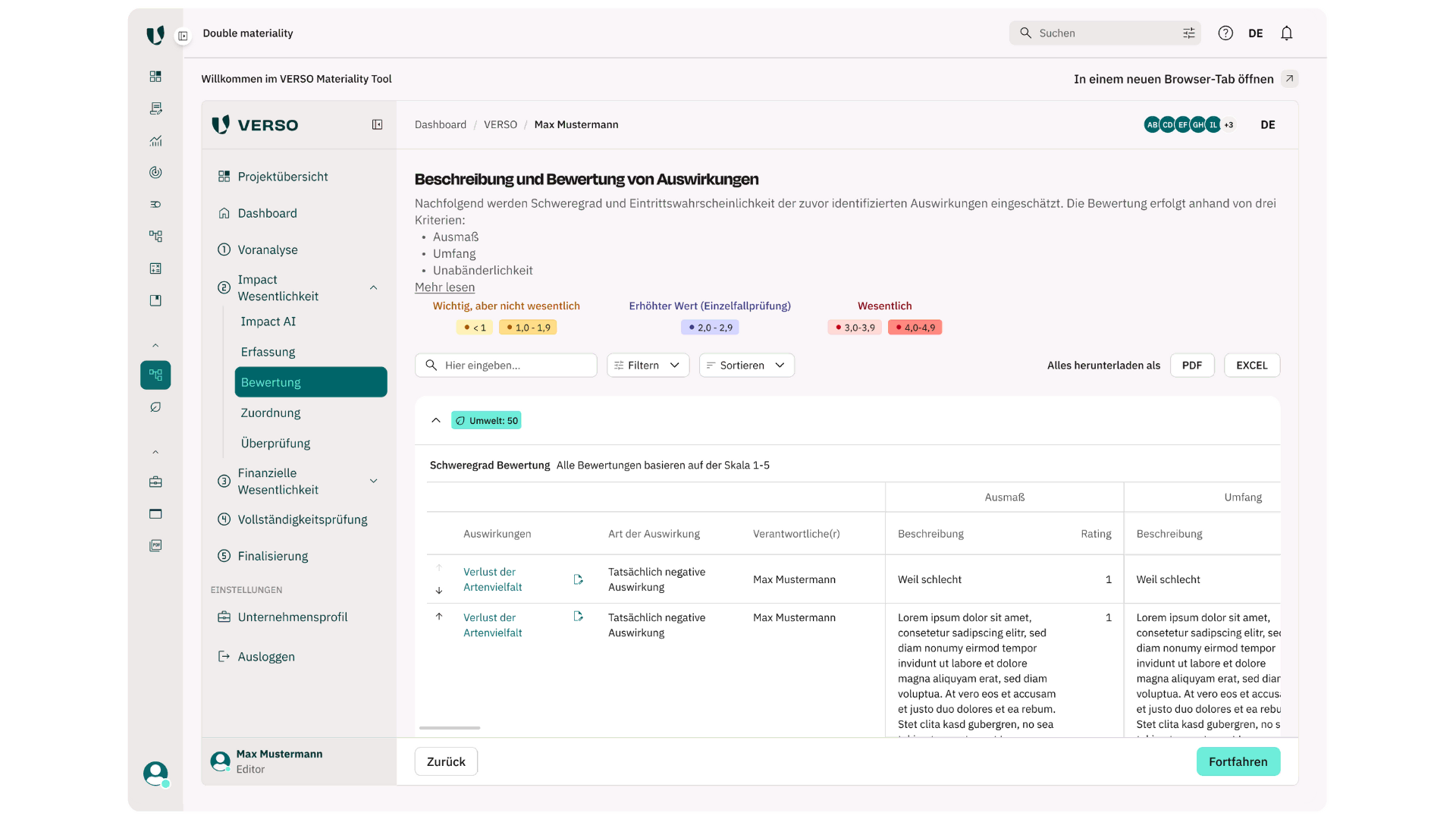

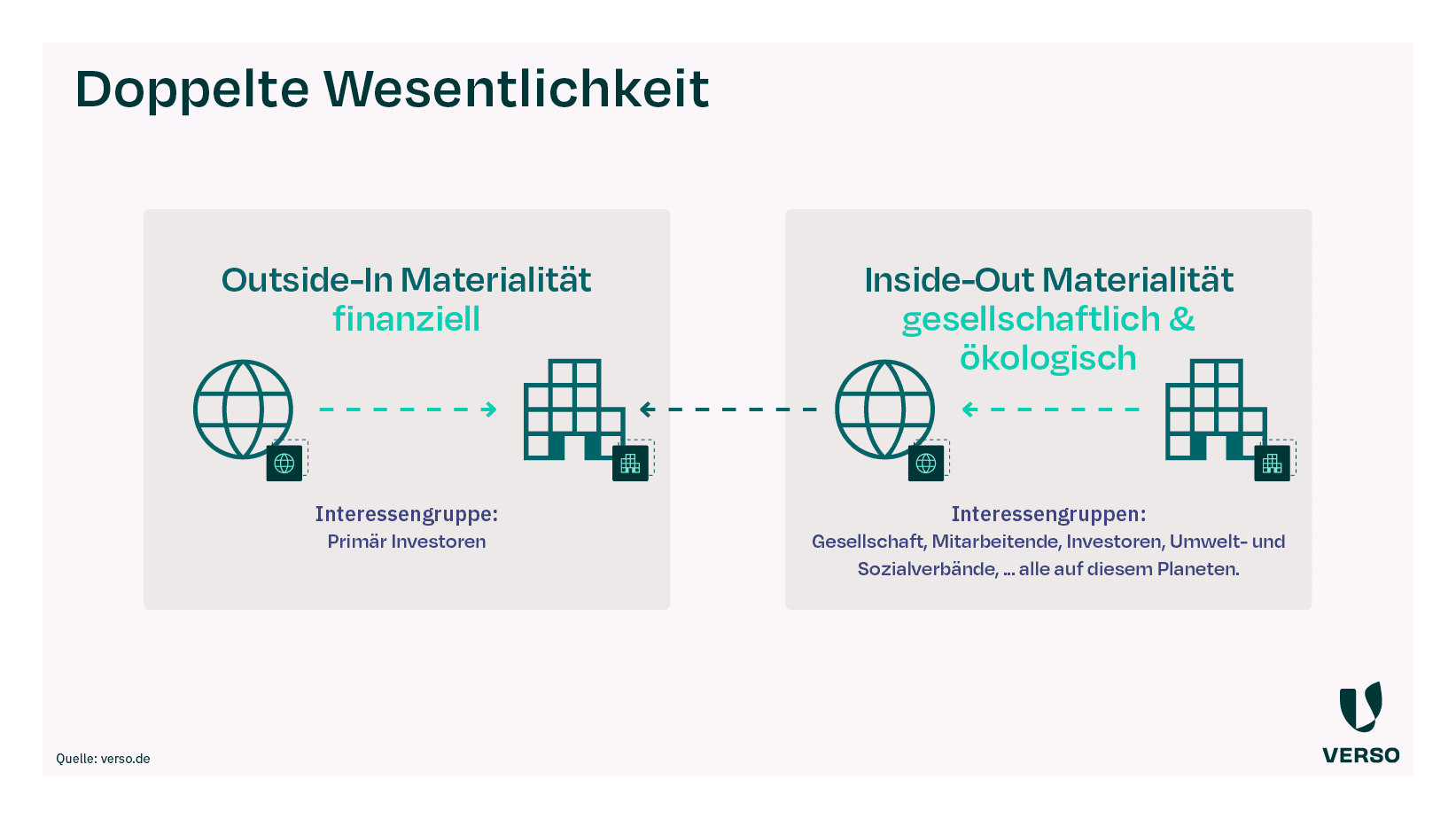

Welche Angabepflichten und Datenpunkte konkret für Ihren CSRD-Bericht wesentlich sind, entscheidet sich auch bei S1 und S2 anhand der Doppelten Wesentlichkeitsanalyse. Im Folgenden betrachten wir die beiden Standards und die Angabepflichten dennoch in ihrer Gesamtheit, auch wenn Sie am Ende vielleicht nicht zu allen Datenpunkten berichtspflichtig sind.

Was sind die ESRS S1 und S2 und warum sind sie wichtig?

Datensammlung und Reporting gehen leichter von der Hand, wenn Sie das „Warum“ dahinter kennen.

Aus der emotionalen Perspektive: Es geht in beiden Standards um Menschen – und das macht sie doch schon automatisch wichtig. In ihrem CSRD-Bericht sollen Sie Ihre Ambitionen, Ziele und Maßnahmen zu einem sicheren und guten Arbeitsumfeld für Ihre Mitarbeitenden und jenen in der Wertschöpfungskette zeigen.

Aus technischer Sicht sollen ESRS S1 und S2 aufzeigen,

- wie sich Ihr Unternehmen auf die Beschäftigten auswirkt (positiv wie negativ, real und potenziell).

- welche Maßnahmen Ihr Unternehmen ergriffen hat, um Auswirkungen zu verhindern, zu mindern oder zu verbessern, und welche Ergebnisse diese Maßnahmen erzielt haben.

- welche Risiken und Chancen in Bezug auf die Beschäftigten bestehen und wie Ihr Unternehmen damit umgeht.

- wie sich die wichtigsten Risiken und Chancen in Bezug auf die Beschäftigten finanziell auswirken können.

Bei S1 beziehen sich diese Angaben jeweils auf die eigenen Mitarbeitenden, bei S2 sind die Beschäftigten in der Wertschöpfungskette gemeint.

Welche konkreten Anforderungen stellen ESRS S1 und S2 an Unternehmen?

Nach dem allgemeinen Blick werden wir etwas konkreter und schauen tiefer in die Standards. Und hier erkennen wir schnell, dass S1 und S2 dem typischen Aufbau der ESRS folgen. Das bedeutet: Zunächst müssen Angaben zu Strategie sowie zum Management der Auswirkungen, Risiken und Chancen (abgekürzt IRO für Impact, Risk and Opportunity) gemacht werden.

Unternehmen sollen ihre strategischen Ansätze beispielsweise zu Arbeitsbedingungen, Weiterbildungsmaßnahmen, Diversität und Chancengleichheit darlegen. Diese Konzepte, wie sie in der deutschen Fassung der ESRS genannt werden, sind oft in der Unternehmensstrategie, den detaillierteren Strategieplänen, dem Code of Conduct oder anderen Richtlinien zu finden.

Die ESRS fordern darüber hinaus Angaben dazu, wie die Beschäftigten eingebunden werden und Fragen an das Management stellen, aber auch Kritik äußern können. Auch nach Beschwerdemechanismen wird gefragt.

Und natürlich sollen Unternehmen angeben, welche Ziele und Maßnahmen sie sich in Bezug auf die Beschäftigten gesteckt haben.

Nach diesen eher allgemeineren Angaben geht es um konkrete Zahlen. Während bei S2 lediglich die Ziele genannt werden müssen, werden bei S1 sehr viele Daten zu den Beschäftigten abgefragt (S1-6 bis S1-17). Ein Auszug als kleiner Vorgeschmack:

- Geschlecht und Alter der Mitarbeitenden

- Beschäftigungsverhältnis

- Menschen mit Behinderungen

- Mitarbeiterfluktuation

- Unfälle am Arbeitsplatz

- Vielfalt in der Führungsebene

- Und viele weitere

Über welche Angabepflichten und Datenpunkte Sie tatsächlich berichten müssen, ist von den Ergebnissen der Doppelten Wesentlichkeitsanalyse abhängig.

In den ersten Jahren Ihrer Berichtspflicht gibt es aber noch einen zweiten Aspekt, warum Sie Angaben zunächst einmal weglassen können – die Phase-in-Regelungen der ESRS. Bei den Standards S1 und S2 gibt es Übergangsfristen, die einzelne Unternehmen wahrnehmen können. Es ist aber trotzdem anzugeben, ob die Nachhaltigkeitsthemen als wesentlich eingestuft worden sind. Hier finden Sie einen Überblick über alle Phase-in-Regelungen der ESRS.

Wie können Unternehmen die erforderlichen Daten sammeln?

Nehmen wir nun an: Sie haben die wesentlichen Themen ermittelt. Und Sie haben entschieden, welche Datenpunkte Sie aufgrund der Phase-in-Regelung auslassen. Damit startet die Datensammlung. Ein Prozess, den Sie mit ein paar Tipps und Hilfestellungen gut meistern.

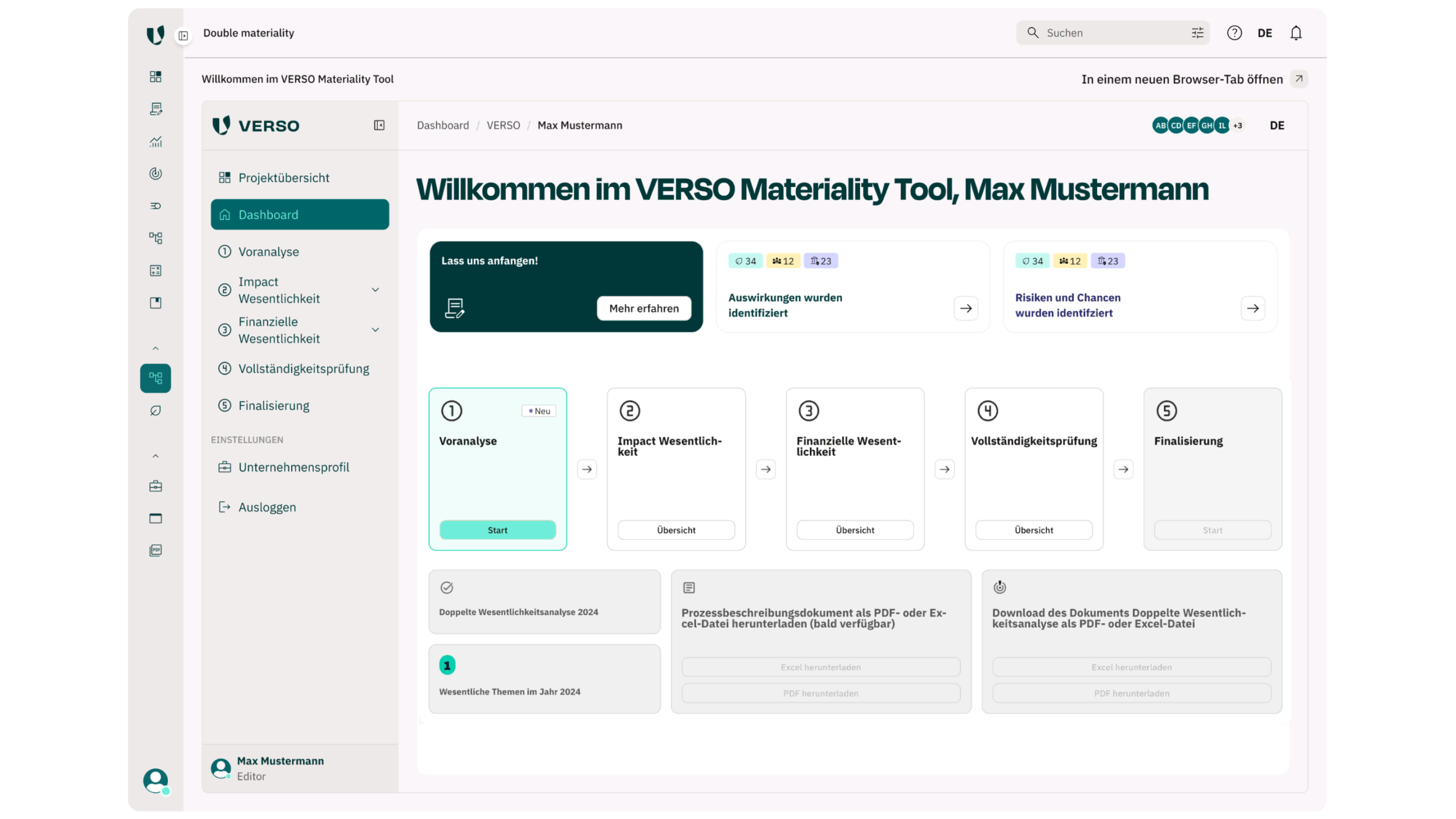

Die Kennzahlen stecken in den Standards S1-6 bis S1-17. Der VERSO ESG Hub erleichtert Ihnen hier die Arbeit. In unserer Software sind Leitfäden und Erklärungen zu den einzelnen Standards hinterlegt. Schauen Sie sich hier genau die Angabepflichten an. Dann erkennen Sie schnell, wo Sie die entsprechenden Daten erhalten können.

Die erste Anlaufstelle ist bei S1 die HR-Abteilung. Sprechen Sie die Kolleg:innen frühestmöglich an und legen Sie eine Ansprechperson fest. Mit dieser können Sie im ESG Hub Schritt für Schritt durch die Angabepflichten gehen und geeignete Prozesse für die Datensammlung etablieren. Durch die Arbeit in der VERSO-Software stellen Sie sicher, dass auch tatsächlich die wesentlichen Daten gesammelt werden. Zudem können dort Verantwortlichkeiten festgelegt und die Daten direkt eingetragen werden.

In einem ausführlichen Blogbeitrag erhalten Sie weitere Tipps für die Datensammlung.

Ähnlich läuft es bei S2 ab. Nur, dass es deutlich weniger Kennzahlen sind und die Daten aus der Wertschöpfungskette stammen, was meist arbeitsintensiver ist. Um dies zu erleichtern und Transparenz in der Lieferkette zu schaffen, haben wir den VERSO Supply Chain Hub entwickelt. Von dort überführen Sie die Daten direkt in den VERSO ESG Hub und erstellen Ihren CSRD-konformen Bericht.

Zum Abschluss: Die Angabepflichten im Überblick

Die Angabepflichten des ESRS S1

Der Standard S1 ist sehr umfangreich. Er umfasst 17 Angabepflichten, allerdings sind nicht alle bereits im ersten Jahr bzw. für alle Unternehmen von Bedeutung. Dies hängt mit den Ergebnissen der Doppelten Wesentlichkeitsanalyse, aber auch mit den bereits erwähnten Übergangsfristen zusammen.

Hier ein kurzer Überblick:

Strategie

- ESRS 2 SBM-2 – Interessen und Standpunkte der Interessenträger

- ESRS 2 SBM-3 – Wesentliche Auswirkungen, Risiken und Chancen und ihr Zusammenspiel mit Strategie und Geschäftsmodell

Management der Auswirkungen, Risiken und Chancen

- S1-1 – Konzepte im Zusammenhang mit den Arbeitskräften des Unternehmens

- S1-2 – Verfahren zur Einbeziehung der Arbeitskräfte des Unternehmens und von Arbeitnehmervertretern in Bezug auf Auswirkungen

- S1-3 – Verfahren zur Verbesserung negativer Auswirkungen und Kanäle, über die die Arbeitskräfte des Unternehmens Bedenken äußern können

- S1-4 – Ergreifung von Maßnahmen in Bezug auf wesentliche Auswirkungen auf die Arbeitskräfte des Unternehmens und Ansätze zum Management wesentlicher Risiken und zur Nutzung wesentlicher Chancen im Zusammenhang mit den Arbeitskräften des Unternehmens sowie die Wirksamkeit dieser Maßnahmen

Kennzahlen und Ziele

- S1-5 – Ziele im Zusammenhang mit der Bewältigung wesentlicher negativer Auswirkungen, der Förderung positiver Auswirkungen und dem Umgang mit wesentlichen Risiken und Chancen

- S1-6 – Merkmale der Arbeitnehmer des Unternehmens

- S1-7 – Merkmale der Fremdarbeitskräfte des Unternehmens

- S1-8 – Tarifvertragliche Abdeckung und sozialer Dialog

- S1-9 – Diversitätskennzahlen

- S1-10 – Angemessene Entlohnung

- S1-11 – Soziale Absicherung

- S1-12 – Menschen mit Behinderungen

- S1-13 – Kennzahlen für Weiterbildung und Kompetenzentwicklung

- S1-14 – Kennzahlen für Gesundheitsschutz und Sicherheit

- S1-15 – Kennzahlen für die Vereinbarkeit von Berufs- und Privatleben

- S1-16 – Vergütungskennzahlen (Verdienstunterschiede und Gesamtvergütung)

- S1-17 – Vorfälle, Beschwerden und schwerwiegende Auswirkungen im Zusammenhang mit Menschenrechten

Die Angabepflichten des ESRS S2

Im Gegensatz zu S1 ist der Standard S2 geradezu schlank. Er umfasst lediglich 5 Angabepflichten. Zu welchen berichtet werden muss, hängt hier ebenfalls von den Ergebnissen der Doppelten Wesentlichkeitsanalyse, und den Übergangsfristen ab.

Hier ein kurzer Überblick:

Strategie

- SBM-2 Interessen und Standpunkte der Interessenträger

- SBM-3 Auswirkungen, Risiken und Chancen und ihr Zusammenspiel mit Strategie und Geschäftsmodell

Management der Auswirkungen, Risiken und Chancen

- S2-1 – Konzepte im Zusammenhang mit Arbeitskräften in der Wertschöpfungskette

- S2-2 – Verfahren zur Einbeziehung der Arbeitskräfte in der Wertschöpfungskette in Bezug auf Auswirkungen

- S2-3 – Verfahren zur Verbesserung negativer Auswirkungen und Kanäle, über die die Arbeitskräfte in der Wertschöpfungskette Bedenken äußern können

- S2-4 – Ergreifung von Maßnahmen in Bezug auf wesentliche Auswirkungen auf Arbeitskräfte in der Wertschöpfungskette und Ansätze zum Management wesentlicher Risiken und zur Nutzung wesentlicher Chancen im Zusammenhang mit Arbeitskräften in der Wertschöpfungskette sowie die Wirksamkeit dieser Maßnahmen

Kennzahlen und Ziele

- S2-5 – Ziele im Zusammenhang mit der Bewältigung wesentlicher negativer Auswirkungen, der Förderung positiver Auswirkungen und dem Umgang mit wesentlichen Risiken und Chancen

Die Datensammlung im VERSO ESG Hub kennen lernen

Um die Angabepflichten von ESRS S1 und S2 zu erfüllen, müssen Sie also eine Menge Daten sammeln. Gerade zu den eigenen Beschäftigten werden zahlreiche Kennzahlen abgefragt. Aufgrund des Umfangs geht schnell der Überblick verloren. Der VERSO ESG Hub ist hier ihr verlässlicher Partner, in dem Sie alle relevanten Daten sammeln und für den CSRD-Bericht nutzen. Überzeugen Sie sich selbst und vereinbaren Sie eine kostenlose Demo.

* Bei diesen Informationen handelt es sich um redaktionell zusammengefassten Content, der nicht als Rechtsberatung zu verstehen ist. VERSO übernimmt keine Haftung.

Das könnte Sie auch interessieren:

Abonnieren Sie unseren Newsletter!

Tragen Sie sich ein und erhalten Sie regelmäßig Neuigkeiten zu:

- Aktuellen ESG-Themen und Gesetzesänderungen

- Best Practices aus den Bereichen ESG und nachhaltige Lieferketten

- News zu VERSO

- Sustainability Events uvm.