ESG regulations oblige executives: What management boards, supervisory boards and management should do now

If companies want or need to tackle the issue of sustainability and ESG, it only makes sense to do so holistically. Holistic in the sense that the entire company must be behind it. First and foremost the managers and supervisory bodies. We explain the to-dos for the top management level.

Why is it important for managers to take an in-depth look at ESG and sustainability?

Firstly, so that the sustainability team has the backing and resources to implement effective measures.

But ESG regulation also demands decisions and transparency on sustainability issues from management boards, supervisory boards and management.

We will now delve deeper into the requirements that ESG regulation places on managers.

Click here for 5 specific tips for compliance.

This information is editorial content that should not be construed as legal advice. VERSO accepts no liability.

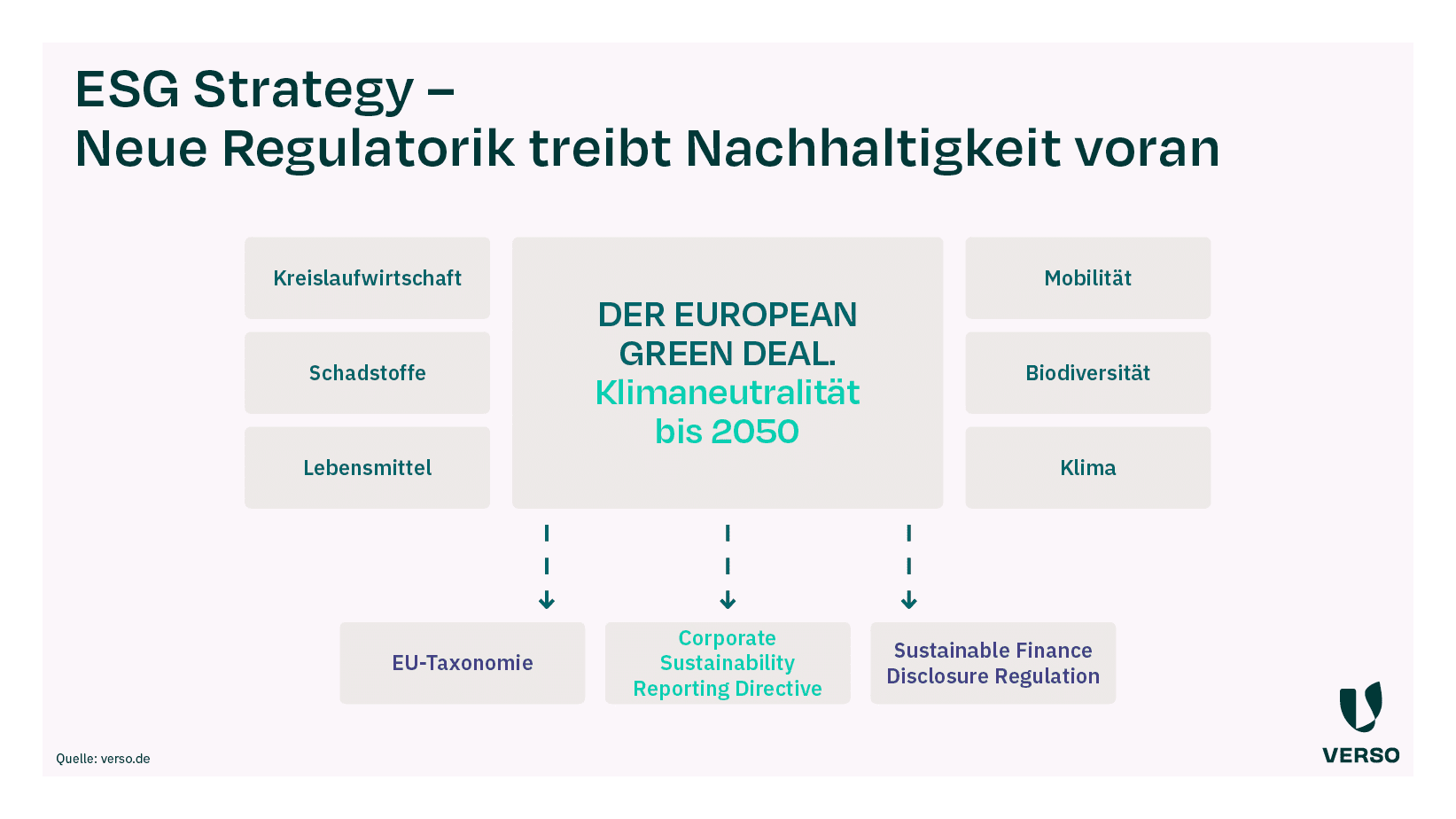

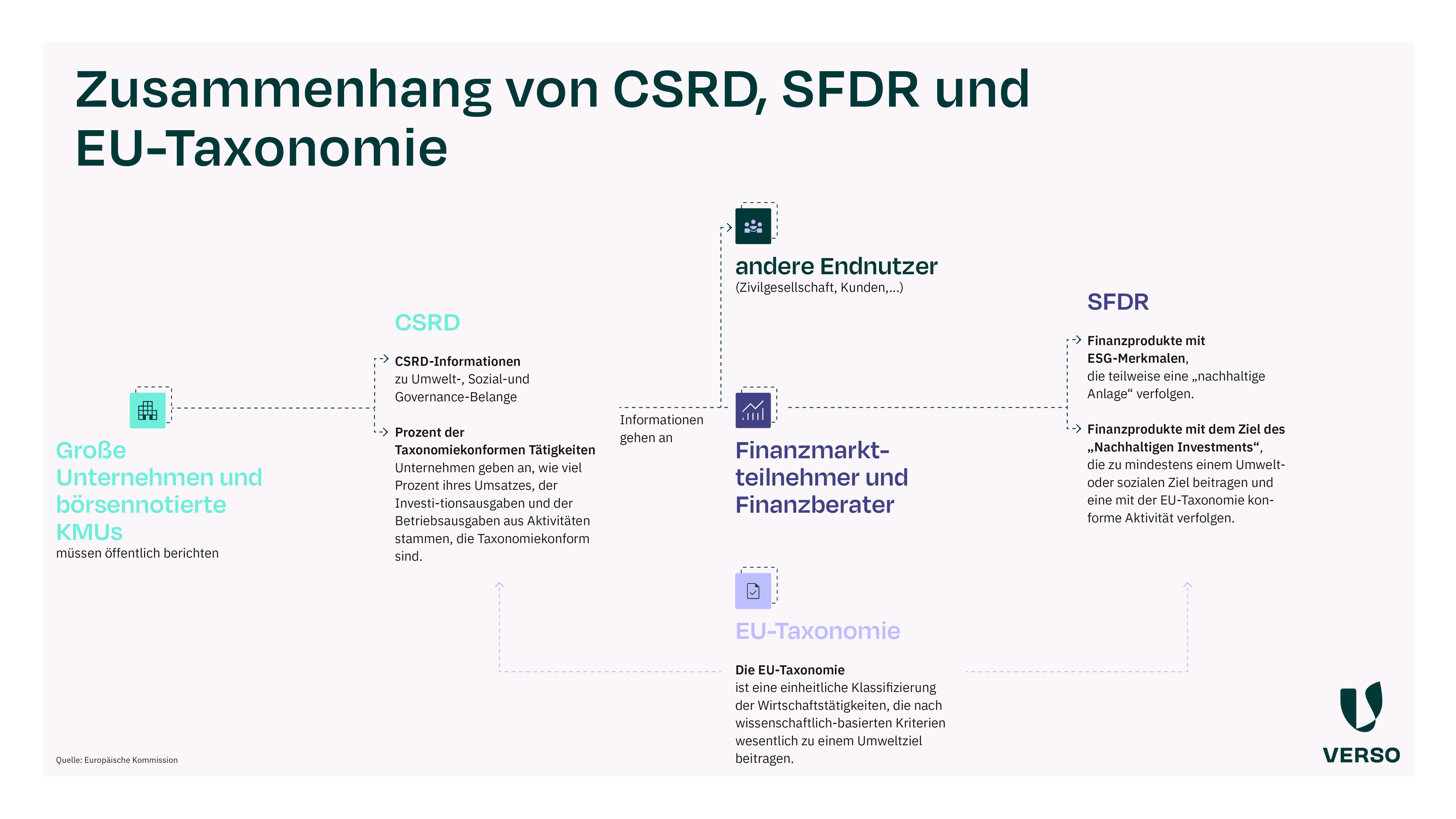

Requirements, obligations and effects of ESG laws

Several ESG laws and guidelines impose obligations on management boards when it comes to sustainability. The demands on the board level are similar in all cases. In short, this means that regardless of whether or when your company is affected by which ESG law, company management must now address ESG objectives. Here you will find an overview of the individual requirements that are relevant for management boards, supervisory boards and management in the currently applicable ESG laws.

The Corporate Sustainability Reporting Directive (CSRD) with the ESRS

Firstly, with its European Sustainability Reporting Standards (ESRS), the CSRD already places clear obligations on the management board level with regard to the review of the sustainability report:

- Monitoring the reporting process

- Ensuring the independence of the auditors

- Forwarding of the audit result for the report to the Supervisory Board

- Creation of capacity for new positions in the ESG team and the development of risk management

- Enabling transparent data collection

- Release of reports for handover to auditors

So much for the review of the report at the end. But even during the reporting process, the Management Board is called upon to act – particularly in the ESRS 2 standard, which is mandatory for all companies and to which all strategic aspects of the topic standards are linked. The governance section of this standard is explicitly aimed at the management board and company management. The following are the To Dos that can be derived from this for the management level: Building ESG expertise:

It is not only the ESG team that needs to be familiar with sustainability issues: The CSRD stipulates (ESRS GOV-1) that you must explain who among the executives and controlling bodies is responsible for ESG issues and oversight of the reporting process. The status of the expertise of these persons with regard to sustainability aspects is also queried. Integration of sustainability into the remuneration model:

The company management must disclose in ESRS GOV-3 whether there are incentive systems for remuneration in the company, how these are structured and whether sustainability performance is integrated into them. So consider how you can adapt your remuneration policy to incentivize the long-term thinking and management of your colleagues. Integrate ESG into due diligence and risk management processes:

Include ESG in all due diligence, corporate decision-making and risk management processes: This is because CSRD requires boards to set out how they inform themselves on ESG issues (including a list of risks, impacts and opportunities that senior management have addressed). They must also consider how they take these sustainability aspects into account in strategic decisions and due diligence and risk management processes. If managers and supervisory bodies fail to comply with their duties, this will not only result in reputational damage or subsequent filings: the CSRD can also impose fines.

The Supply Chain Due Diligence Act (LkSG)

The German Supply Chain Act currently affects companies with 1,000 or more employees. Companies must prove that due diligence obligations are being complied with in their supply chain. For this purpose, a comprehensive report must be submitted to the Federal Office of Economics and Export Control (BAFA). The LkSG has a direct impact on the highest company levels. This is because it concerns risk assessment and risk minimization in a company’s supply chain. Decisions for or against business partners, suppliers, expansions into other countries – these are important strategic decisions that go beyond the remit of purchasing. They may not require the involvement of the board level at the beginning of the process – e.g. during risk analysis. However, later on – e.g. when it comes to risk minimization measures – the management, Executive Board and Supervisory Board are always required. After all, risk minimization also affects the company as a whole and ensures its future viability. Violations of the LkSG are punished as administrative offenses. This means that sanctions can be imposed not only on companies, but also on the individuals involved. The acting persons in the company are the management – they can therefore be held responsible. In addition, the supervisory board must also monitor LkSG compliance in its control and advisory function. If it fails to do so adequately, the supervisory board is also liable. The consequences are fines (depending on the violation and severity) of up to EUR 100,000, up to EUR 500,000 or up to EUR 800,000 per violation. In special cases, a stricter regulation, the turnover-based penalty, may also apply.

The European Supply Chain Directive (CSDDD)

The Corporate Sustainability Due Diligence Directive (CSDDD) is the European equivalent of the German Supply Chain Act. It is currently envisaged that it will not have a greater impact on German companies than the German LkSG already does. Nevertheless, there are also requirements here that impose ESG obligations on the management board level: Accordingly, companies must disclose a strategy that is compatible with the 1.5°C target of the Paris Agreement. This ESG strategy should not only contribute to the climate targets on paper. It must be demonstrated that the variable remuneration of the Management Board is also dependent on the efforts to implement a climate plan. The regulation explicitly obliges management to act not only in the interests of the company, but also to take sustainability aspects into account. In addition, the CSDDD obliges the management to establish and monitor measures for the fulfillment of due diligence obligations. The management must then also report on this to the Executive Board.

Other ESG obligations

Although the EU has recently passed some laws specifically in the area of sustainability, there are also other laws and voluntary commitments that require ESG commitment from board members and executives. Below you will find two specific examples:

- Shareholder Rights Directive: According to the directive, the remuneration structure of the Management Board of listed companies must be geared towards the sustainable and long-term development of the company.

The aim is for the Supervisory Board to also take social and ecological aspects into account when setting salaries. - German Corporate Governance Code: The GCGC is a voluntary commitment by the business community and provides listed companies with standards for good and responsible corporate governance.

Here, too, the remuneration structures for Management Board members must be aligned with ESG aspects.

5 Measures for management boards to prepare for ESG obligations

You now know that the management board, supervisory board and managing directors must all take responsibility for sustainability in companies. There is a lot to do – to get you from reading to doing, here is a list of measures and topics that the management level should implement – regardless of which law the company is or will be affected by and when.

1. get yourself (and your team) ready to go

- Determine who on the Management Board is responsible for sustainability and set up internal committees to take sustainability aspects and requirements into account in your strategies.

- Define the responsibilities for implementing the ESG strategy and ESG objectives.

Form an ESG team.

Equip it with the necessary knowledge for implementing the sustainability strategy and for reporting.

2. carry out an ESG update of your corporate strategy

- Integrate short and long-term ESG goals into the corporate strategy.

This will prevent conflicts of interest and give the topic the importance it deserves.

Ensure that sustainability is a fixed and central component of your corporate strategy.

You will benefit from long-term business success. - Evaluate whether the company’s purpose, vision and values are in line with your sustainability strategy.

- Discuss in the team whether the remuneration structures (especially for managers and supervisory bodies) should be aligned with sustainability aspects.

On the one hand, this is required by all ESG regulations; at the same time, studies (Via Tomorrow) show that these practices are already widespread and highly effective.

3. keep an eye on your ESG risks

- Take a look around you: How are other companies or stakeholders dealing with ESG risks?

What sustainability measures are they implementing?

How does your company compare? - Carry out a materiality analysis with your ESG team. This will allow you to identify the opportunities, impact and risks of your company in terms of sustainability. Take the first countermeasures for the most urgent risks.

- Identify your opportunities and position yourself for the future.

Update your ESG risk and opportunity assessments regularly, just like other topics.

Include sustainability aspects in your regular risk management.

4. support your ESG team

- Empower the team to set up the processes for reporting and control mechanisms.

- Gain a rough overview of the frameworks, methods and EU regulations. This will enable you to make well-founded decisions for the implementation of the sustainability strategy.

5. stay on the ball

- Establish a process within top management to regularly reassess ESG issues and improve your strategy.

Regularly coordinate ESG and sustainability issues within the board and management: ESG issues are related to financials.

Establish a regular exchange between the operational ESG team and the management level. - Good sustainability management requires a lot of knowledge.

Not only in the ESG team.

As mentioned at the beginning, sustainability is an issue for the entire company.

Therefore, make sure that all employees receive regular training on the ESG topics relevant to them and are integrated into the ESG processes and measures.

After all, you can only make a difference if everyone is on board.

And don’t forget the top level: management, the Executive Board and the Supervisory Board also need up-to-date sustainability knowledge – to comply with the law, but also to be able to make good corporate decisions.

Meet your ESG obligations with VERSO

Especially in the initial phase, it is not easy to get into action – too many unanswered questions, little efficiency in the processes, hardly any experience with sustainability in the team.

What are sensible measures?

What exactly should a sustainability strategy look like?

How do we approach the materiality analysis efficiently?

Trust us, we have been doing this for a long time – for more than 10 years to be precise.

This might also interest you:

Subscribe to our newsletter!

Register now to arrange a free demo appointment and get to know our solutions at first hand.

- Pragmatic all-in-one solution for ESG reporting, climate and supply chain management

- Individual advice from the VERSO experts

- Developed with expertise from 12+ years of sustainability management

- Trusted by 250+ customers