The EU ESG guidelines and how they relate to each other

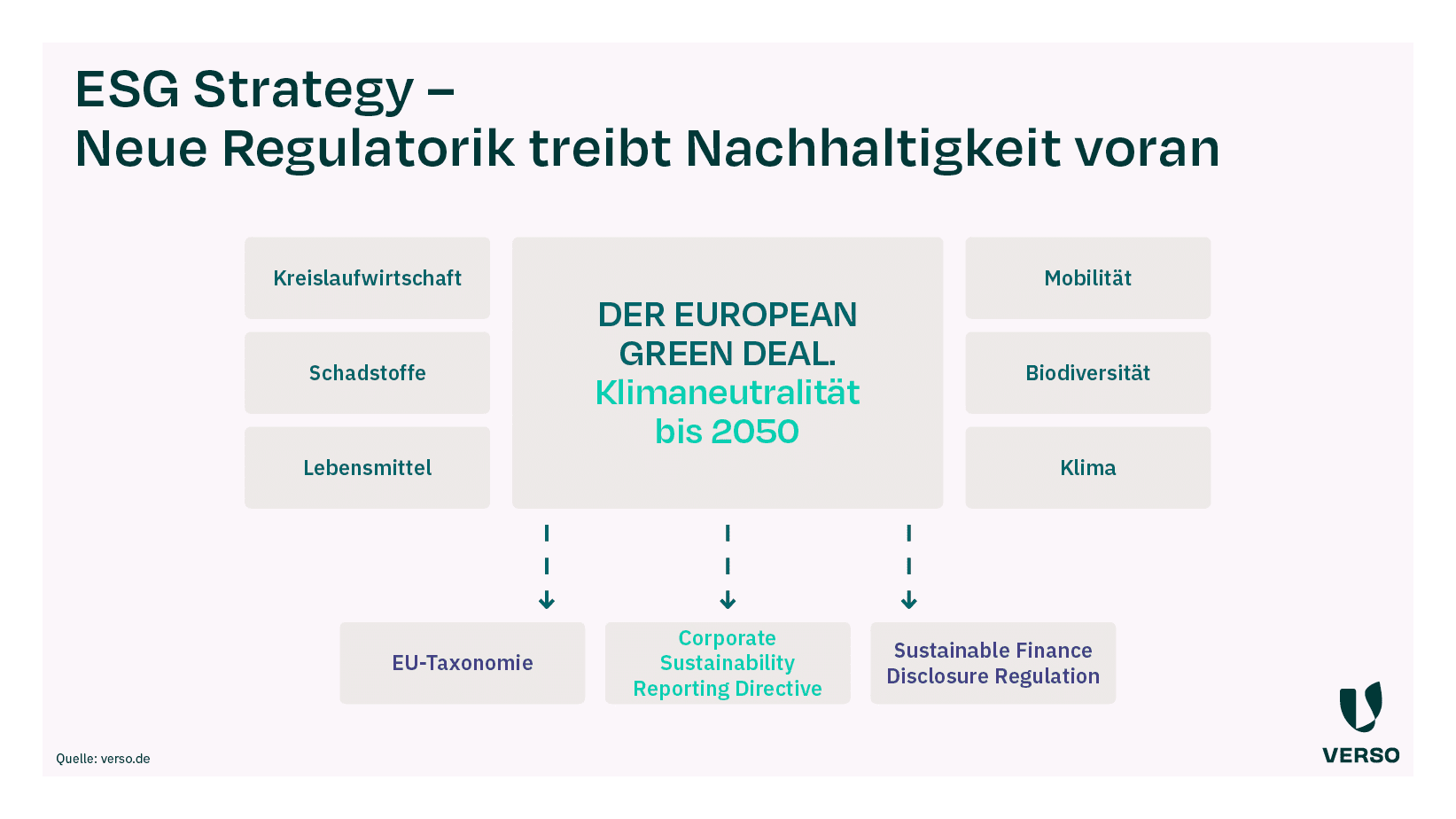

The European Union’s Green Deal

With its Green Deal, the European Union wants to make the EU climate-neutral by 2050 and channel financial flows into sustainable projects and companies.

The extensive program also includes three important ESG guidelines and regulations for sustainability reporting:

- EU taxonomy,

- Corporate Sustainability Reporting Directive (CSRD) and

- Sustainable Finance Disclosure Regulation (SFDR).

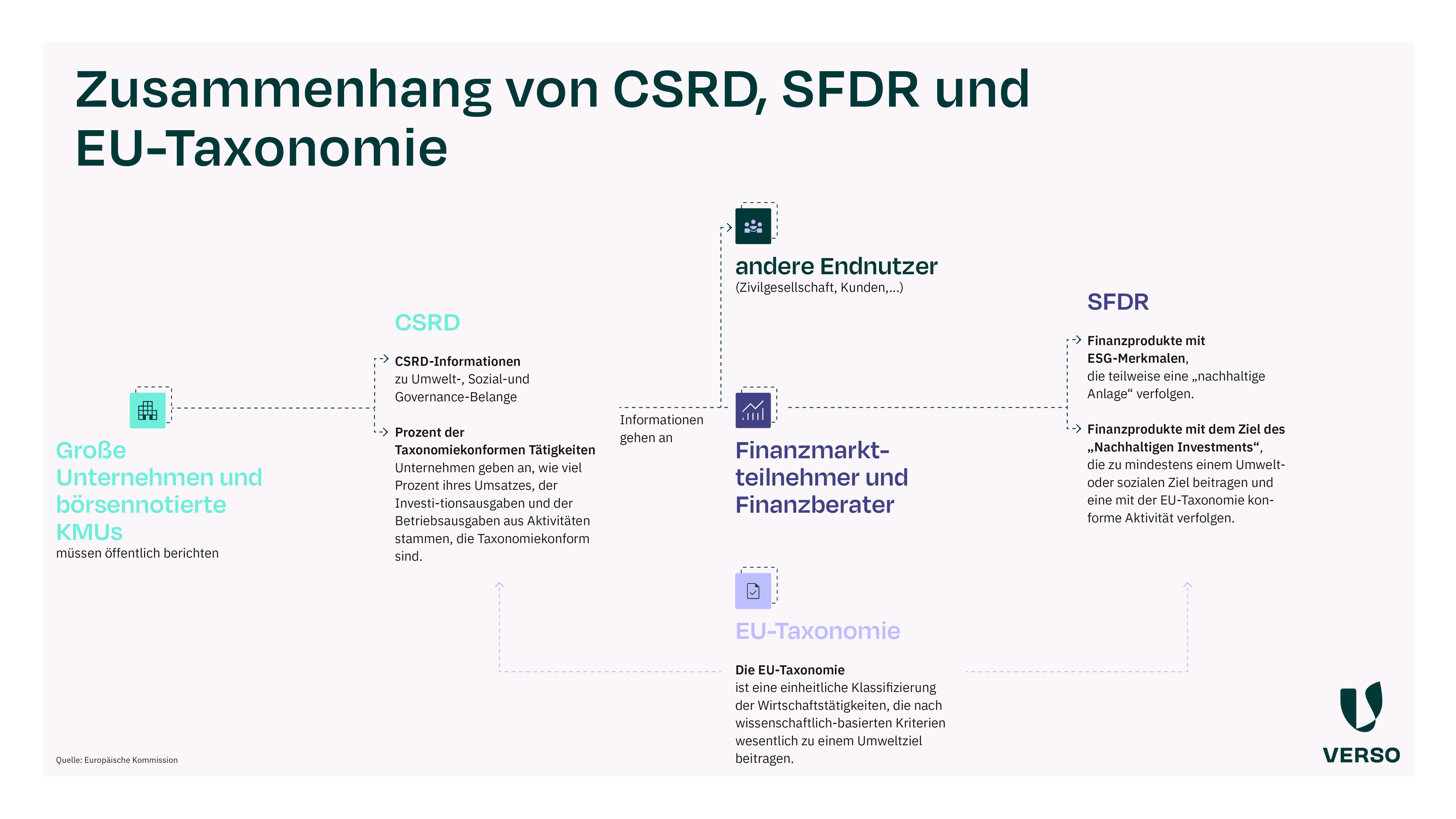

But how are they connected and why are all three important for companies?

EU taxonomy, CSRD and SFDR briefly explained

Before we take a closer look at the relationship between the EU taxonomy, CSRD and SFDR, we will first look at the three EU requirements individually.

The European Union adopted the EU Green Deal back in 2019.

The program provides for extensive measures that penetrate deep into the economy and industry.

This also includes the three directives.