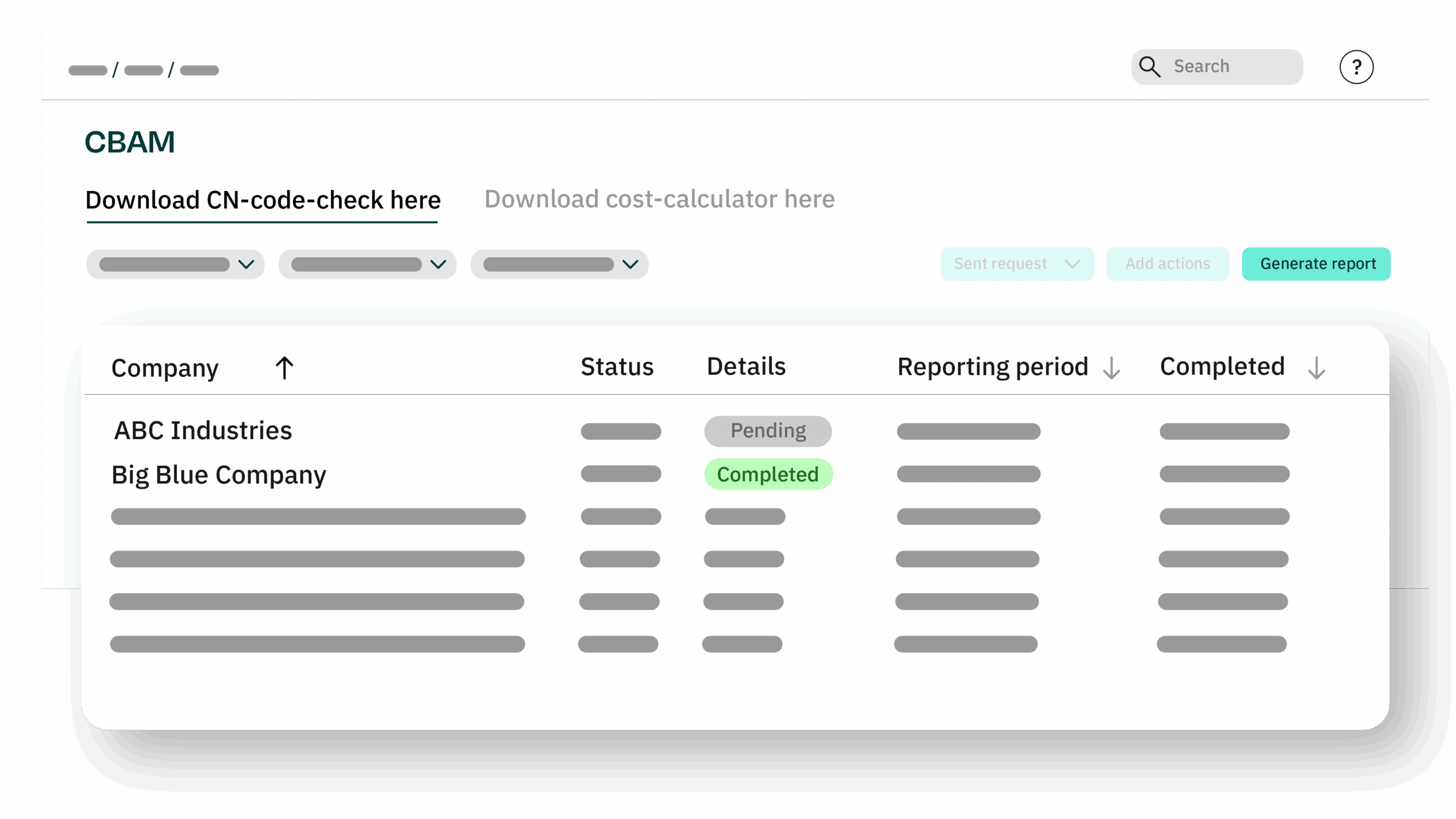

Track CBAM Data Without the Chaos

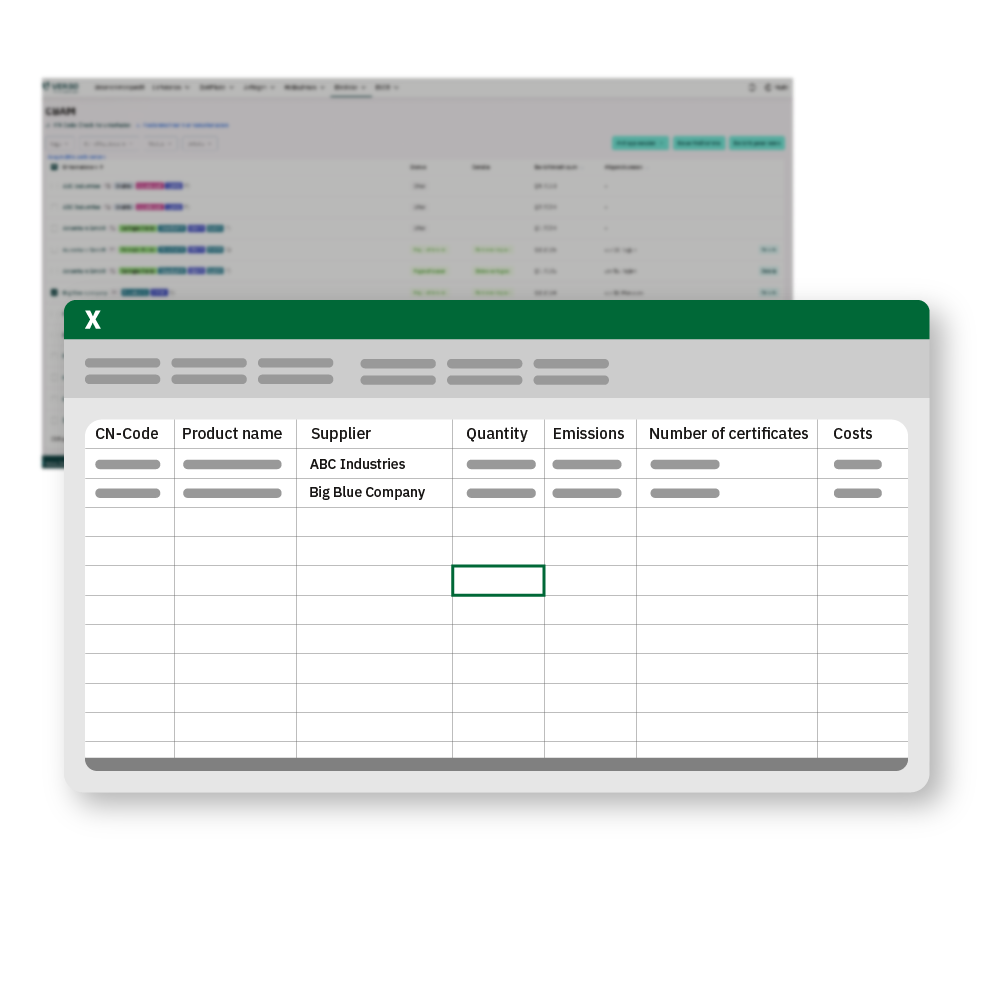

Collect emissions data, forecast certificate costs, and generate reports: with the CBAM Reporting Software in the VERSO Supply Chain Hub, you meet all requirements — legally compliant, automated, and efficient.

The VERSO Supply Chain Hub is user-friendly, intuitive, and clearly structured. The strengths include the clear result display, risk analysis by industry and country, the depth of the assessments, strong collaboration with the VERSO team, and excellent supplier support.

What is CBAM about?

The CBAM is the EU’s new carbon border adjustment mechanism. Its goal: to apply the same CO₂ pricing to imported goods as to EU-made products. Starting in 2026, importers of certain raw materials or products will need to collect and report emissions data — and compensate them via certificates.

Sounds complex? It is. But the CBAM reporting module by VERSO simplifies the entire process of reporting and offsetting emissions.

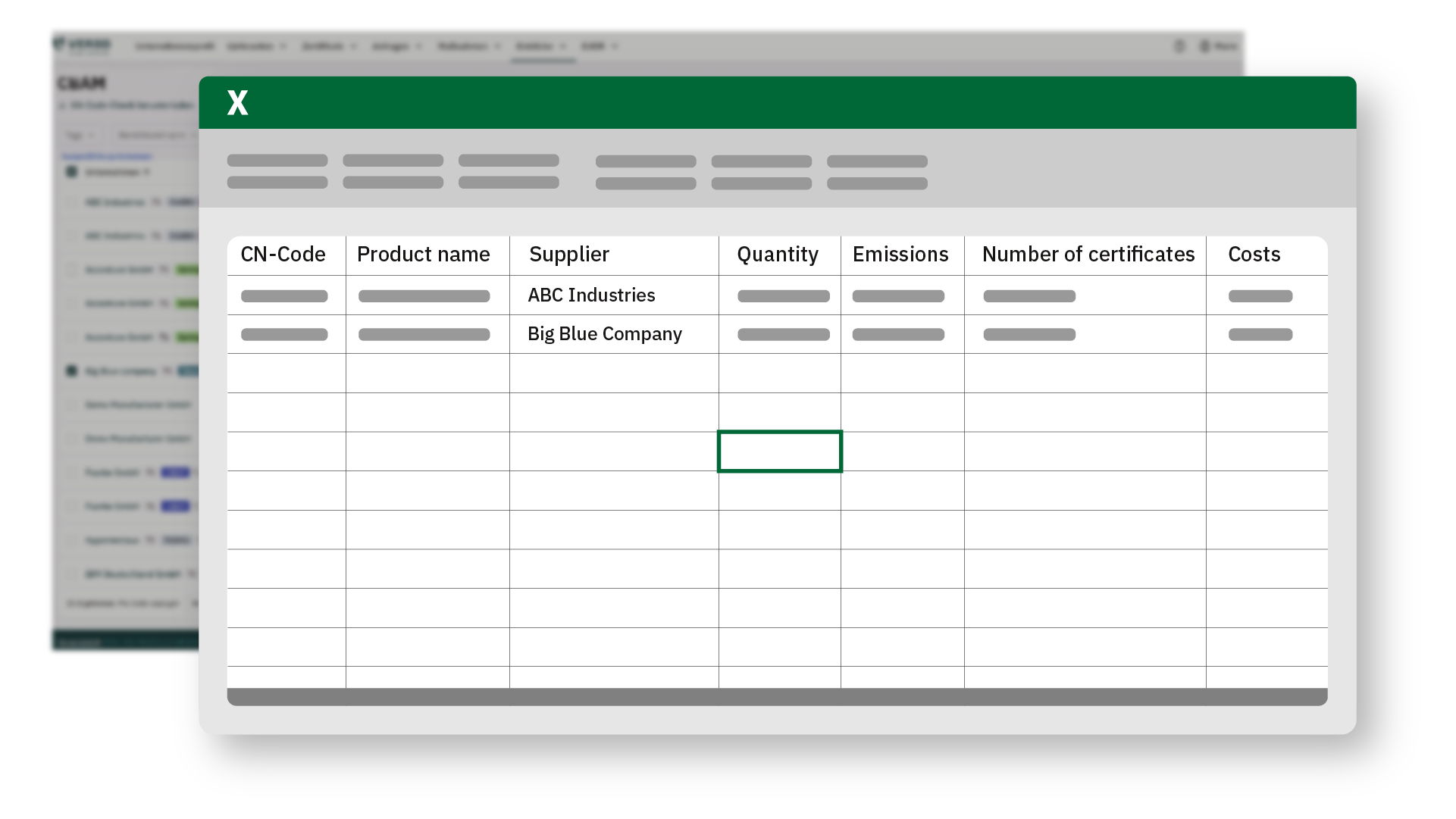

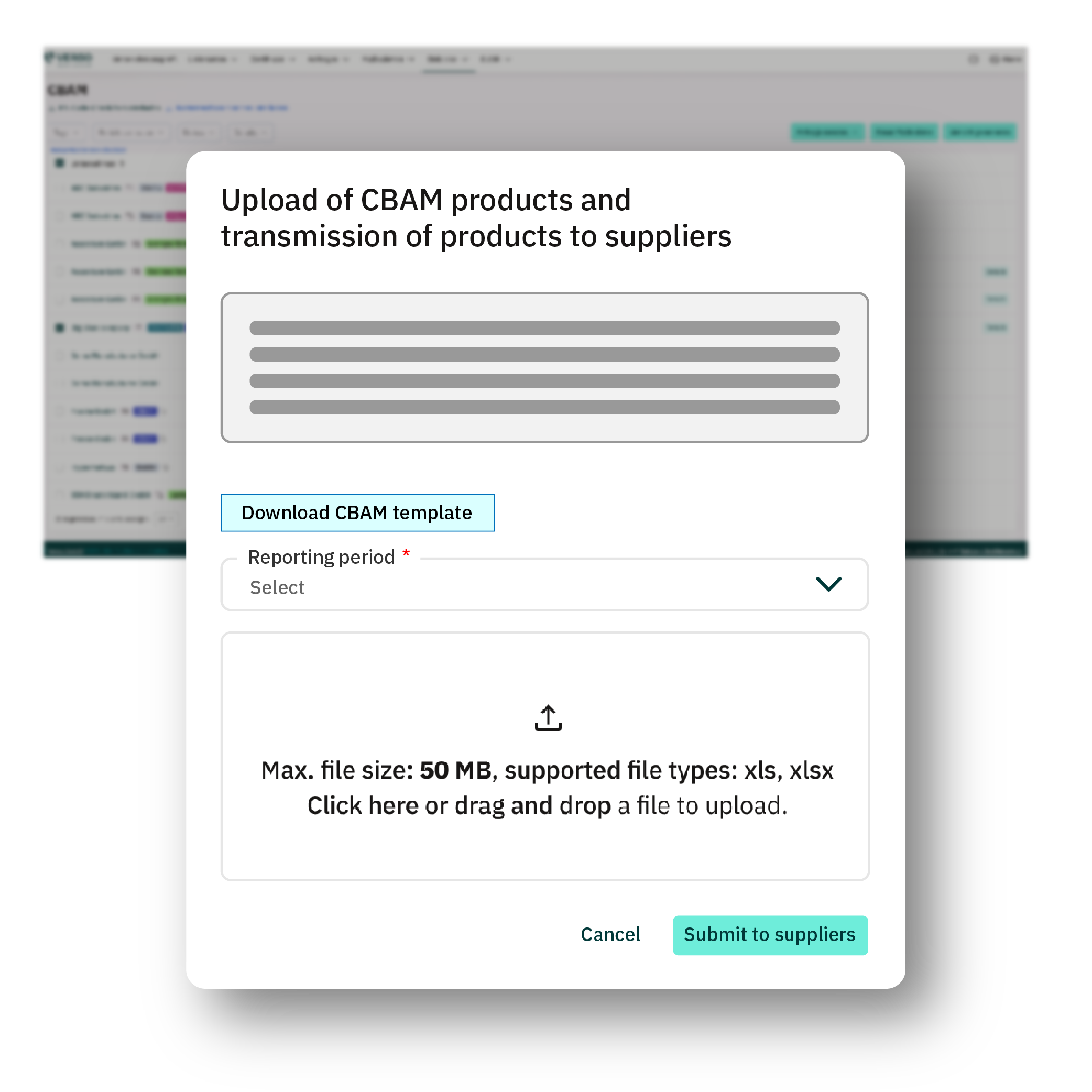

Identify Relevant Products and Suppliers

Quickly identify which of your products fall under CBAM by comparing your CN codes using VERSO’s automated matching feature. Assign codes to specific suppliers for greater clarity.

- Automated CN code matching

- Live updates as the regulation evolves

- Bulk upload of product and supplier data

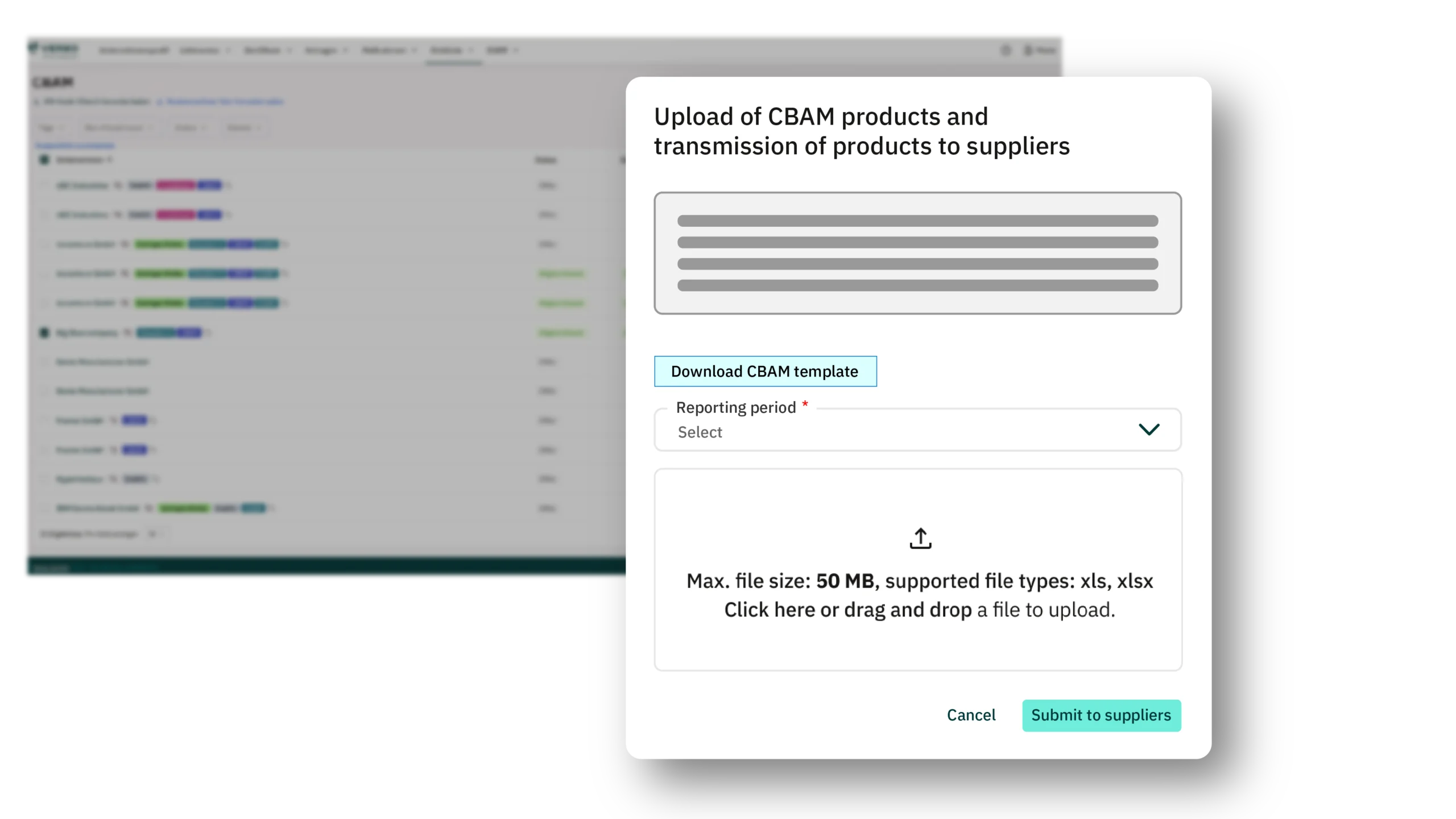

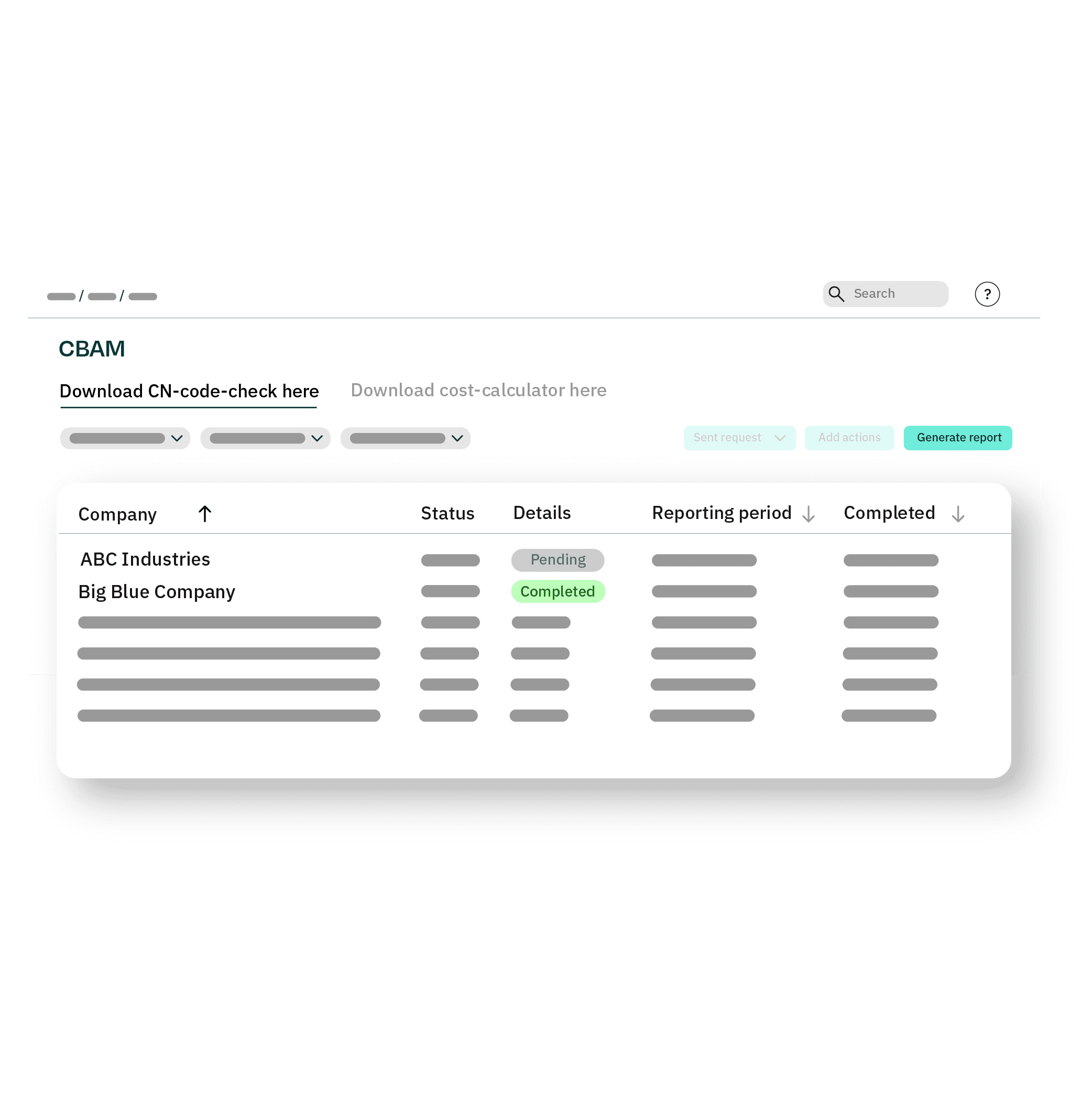

Structured CBAM Data Collection

Request all required data from suppliers at the click of a button. Standardized data uploads and automatic plausibility checks help reduce errors.

- Standardized CBAM requests

- Automated reminders for missing responses

- Full documentation of all contact attempts

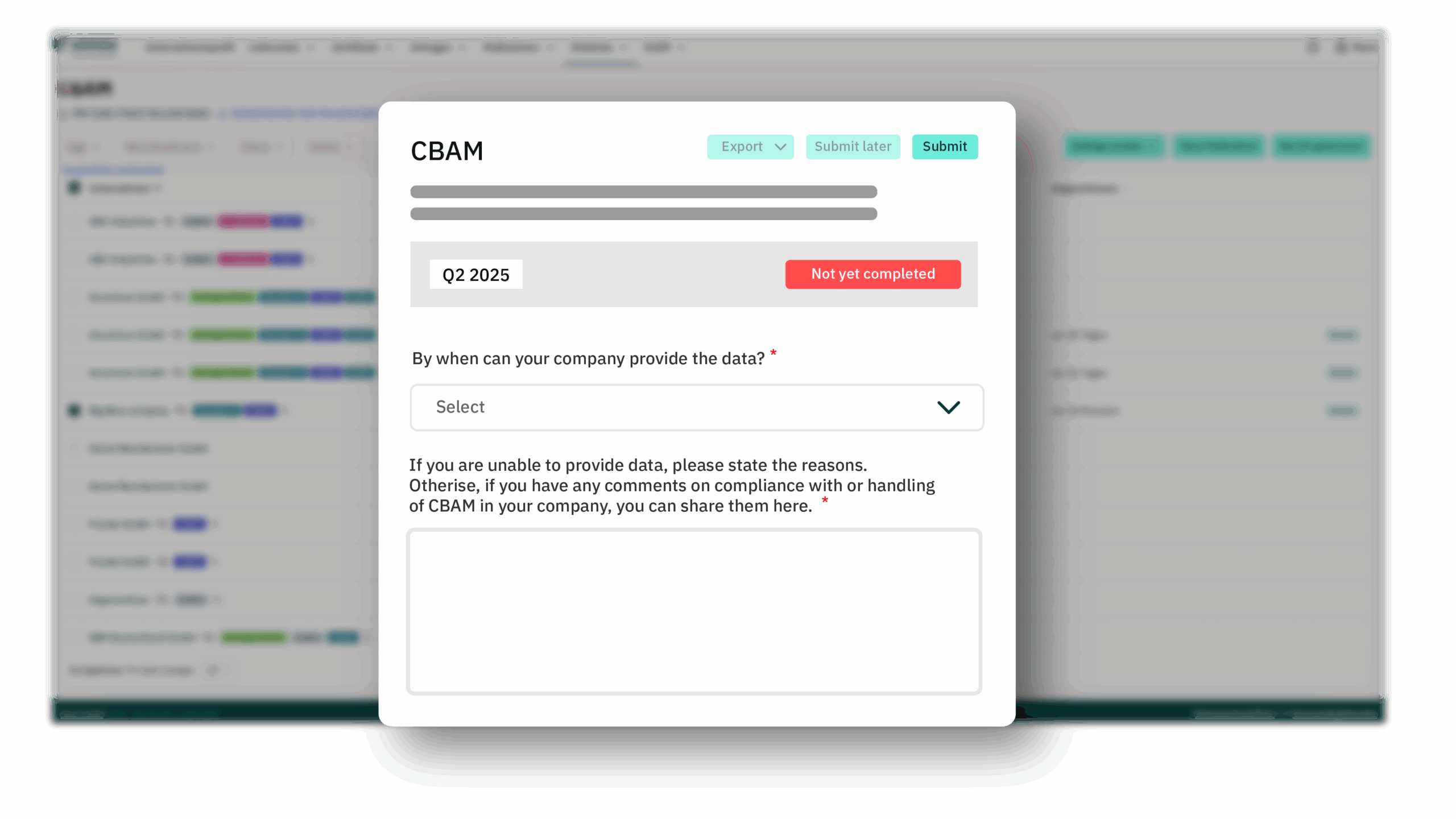

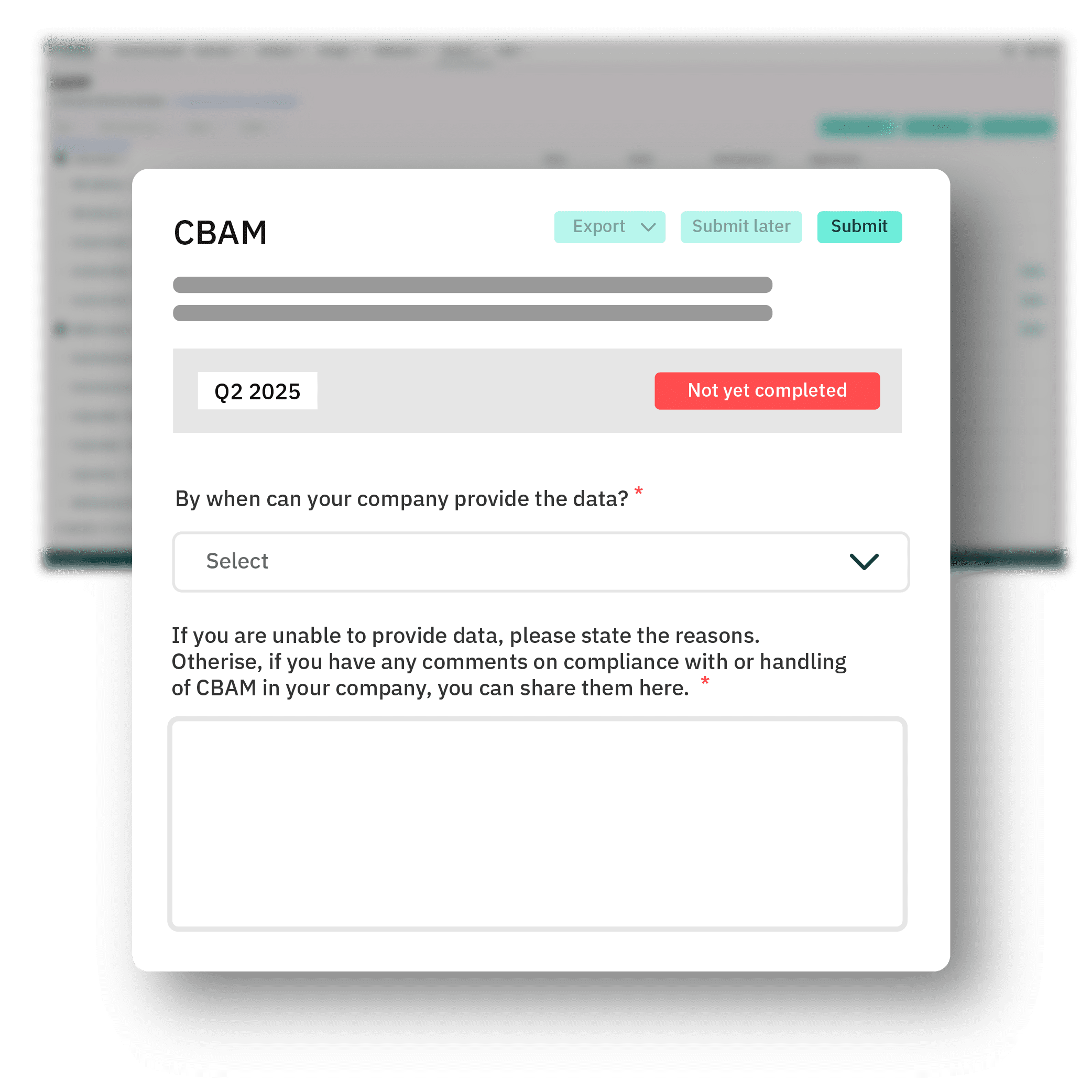

Validate Data and Document Gaps

Suppliers must explain any missing data during upload. VERSO enables automated plausibility checks and stores justifications in an audit-proof manner.

- Built-in plausibility check during data entry

- Justification log for missing data

- Helpdesk and knowledge base support

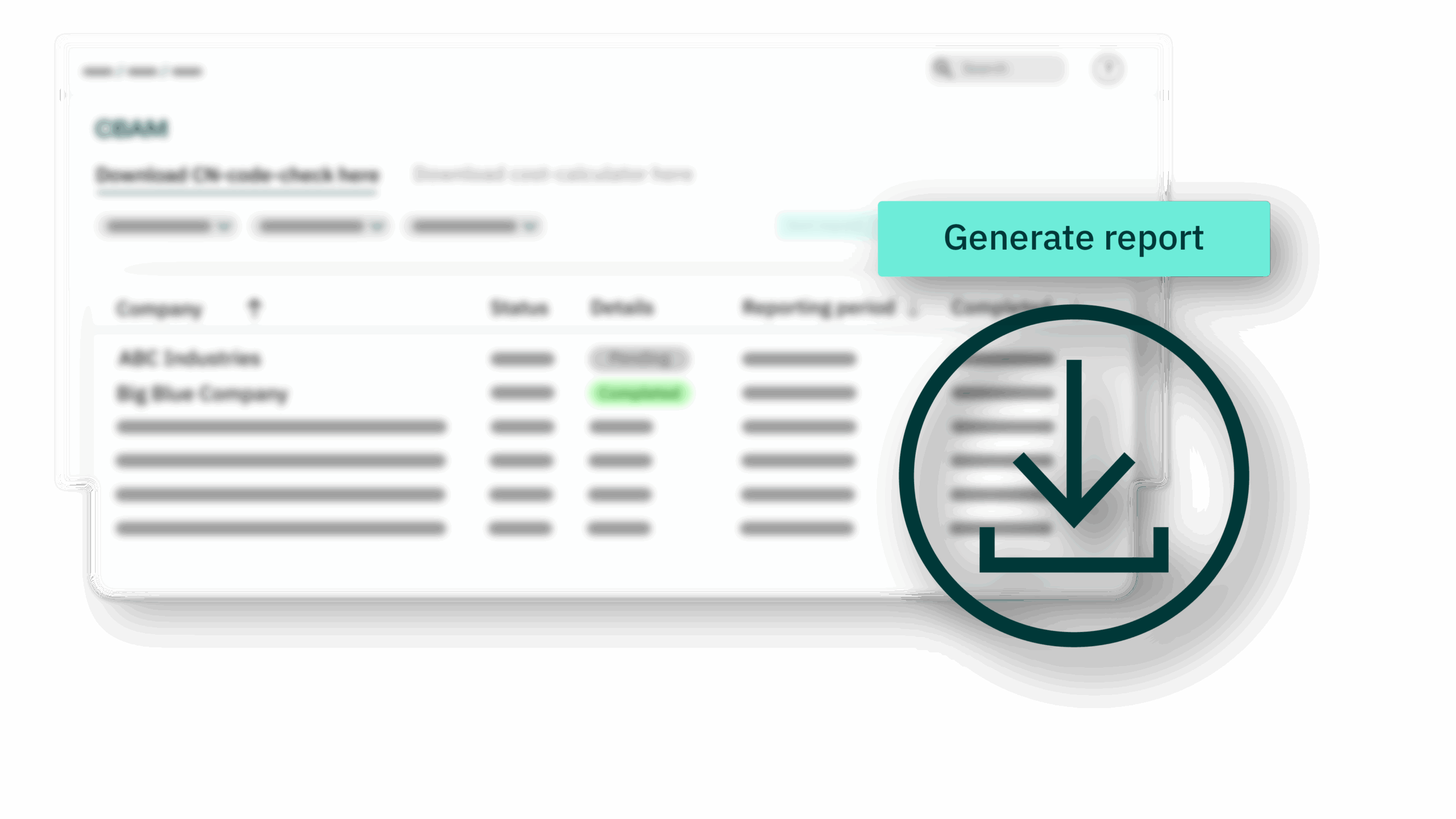

Generate CBAM Reports Automatically

Centralized data management makes reporting easier. Analyse and consolidate data for each reporting period and export directly to the CBAM Register.

- Auto-export by reporting year or quarter

- Clear overview of all reportable products

- Ready for CBAM Register submission

Forecast Certificate Costs

Plan your CBAM budget using verified data — and understand the financial impact early. As certificate requirements begin, the system calculates future costs based on supplier emission data.

- Certificate cost calculation

- Quarterly updates based on imports

- Supplier climate maturity insights

VERSO – Your Trusted Partner for CBAM Compliance

Since 2010, VERSO has supported medium-sized companies on their sustainability journey. Our CBAM Reporting Software is part of the modular VERSO Supply Chain Hub and was developed together with legal and supply chain experts — for companies that want to combine regulatory confidence with operational efficiency.

Book Your Demo Now!

Discover in a free demo how VERSO’s CBAM software solution simplifies your path to CBAM compliance.