Ready for the CSRD reporting obligation?

In addition to high regulatory requirements, the CSRD reporting obligation raises many questions: Does it apply to my company? What needs to be done? And how can it be implemented in a legally compliant way? Find answers together with VERSO. Turn your sustainability data into audit-ready CSRD reports with us.

CSRD compliance: not that easy after all?

Preparing a CSRD-compliant report is a complex and demanding task. What is intended as a meaningful measure to create sustainability reports with real impact can put ESG managers under significant pressure:

- ESG data collection: Where do I start? How do I determine how sustainable my company and my supply chains currently are?

- Double materiality analysis: Which of the countless data points do I actually need to report on?

- Strategy: How exactly do the ESRS work? How do I plan an effective sustainability strategy?

- Security: How do I ensure that my report gets through the audit safely?

- Understanding: Why am I doing this at all – and how do I go about it?

At the same time, the CSRD is still relatively new, meaning there is limited practical experience to draw on. And that certainly does not make things any easier, does it? With VERSO, you gain confidence through a clear data foundation and meet your CSRD reporting obligation in a strategic way.

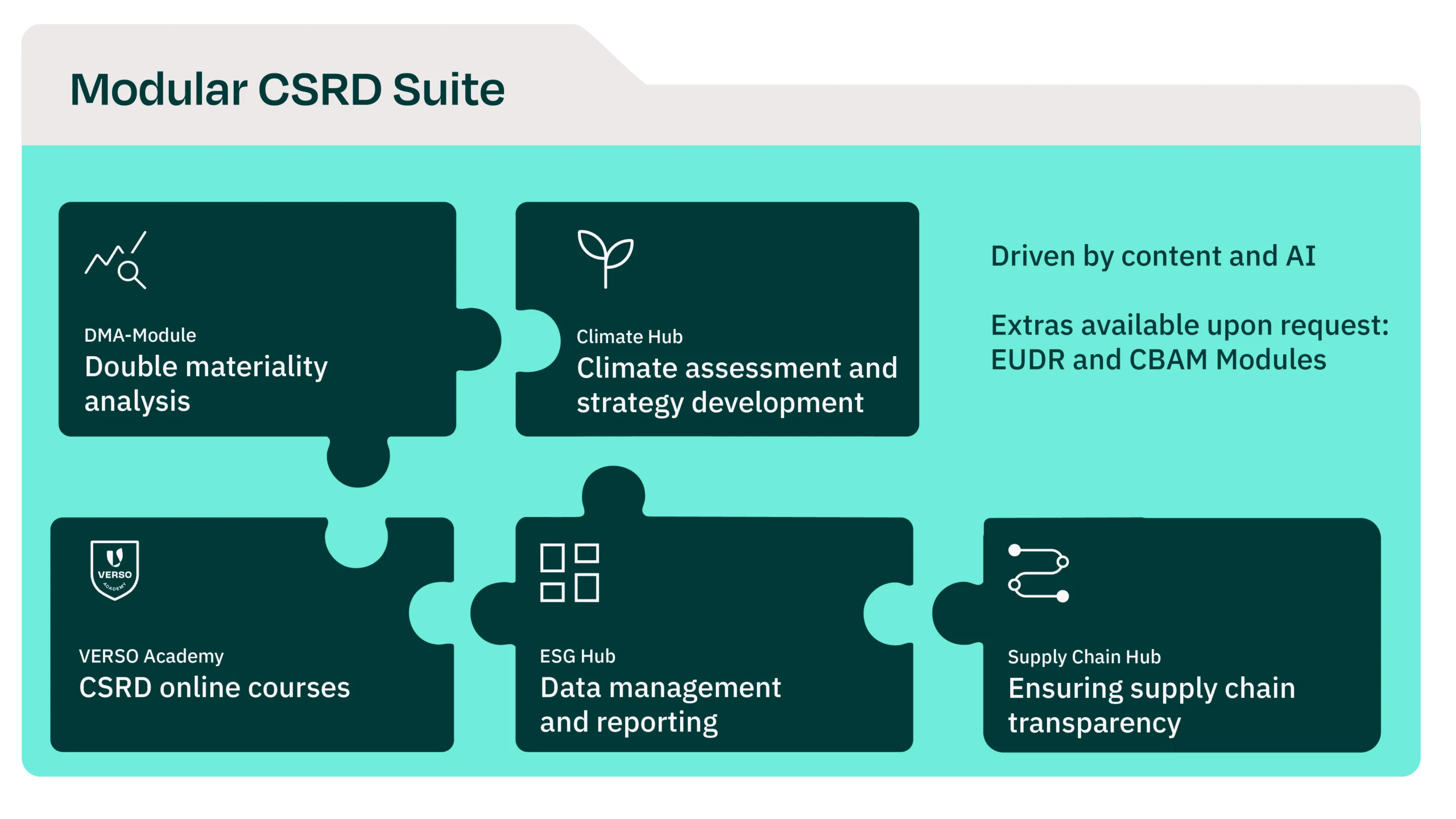

Implementing the CSRD reporting obligation step by step

Double materiality analysis

… with our AI-powered solution. This IDW- and CSRD-compliant, certified module gives you the starting point for your CSRD report in no time: an audit-ready double materiality analysis.

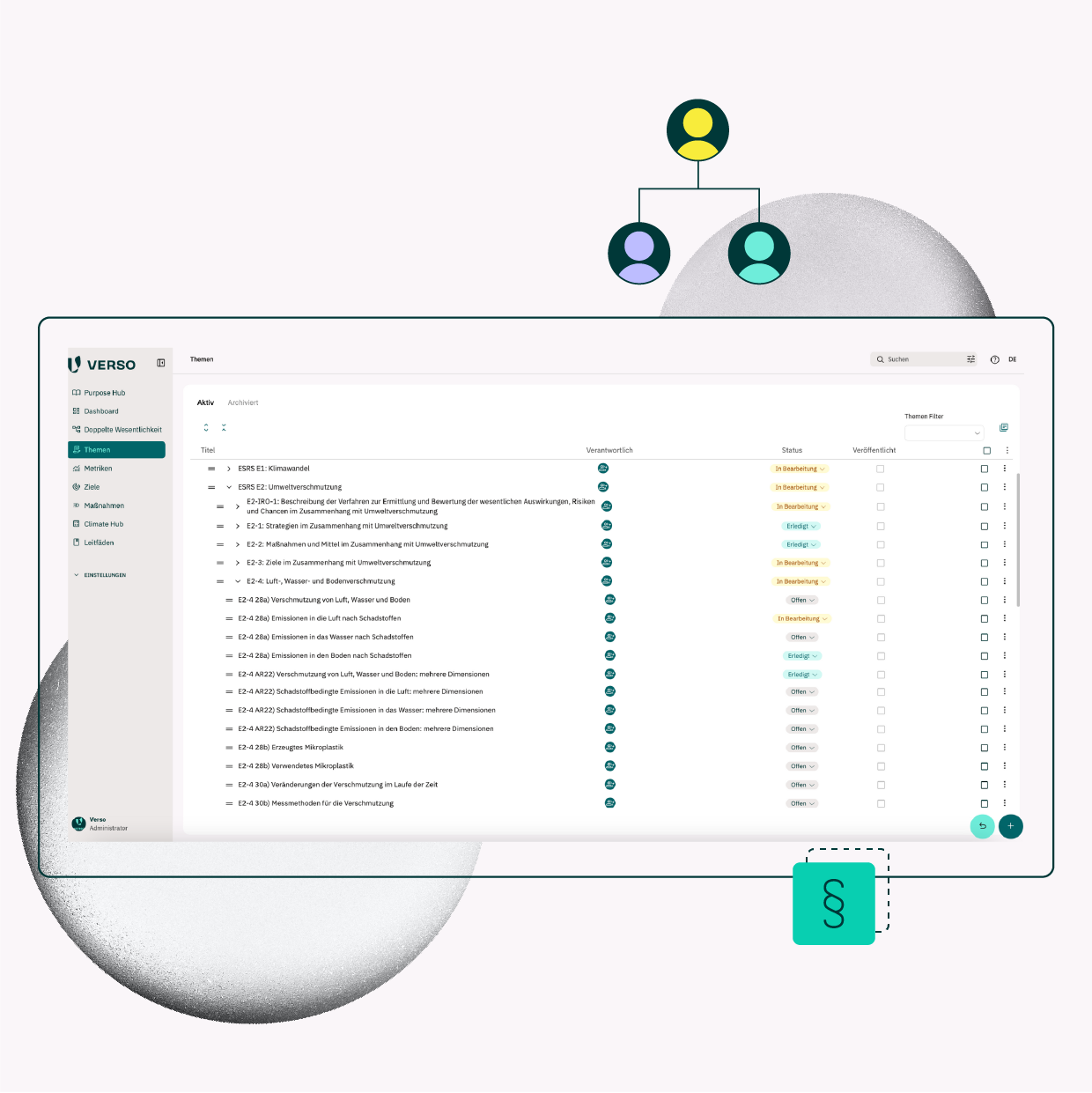

ESG data management & reporting

… with the VERSO ESG Hub. With our CSRD compliance software, you gain access to a digital cockpit for ESG managers. Centralize your ESG data and create a CSRD-compliant report in a simple and secure way.

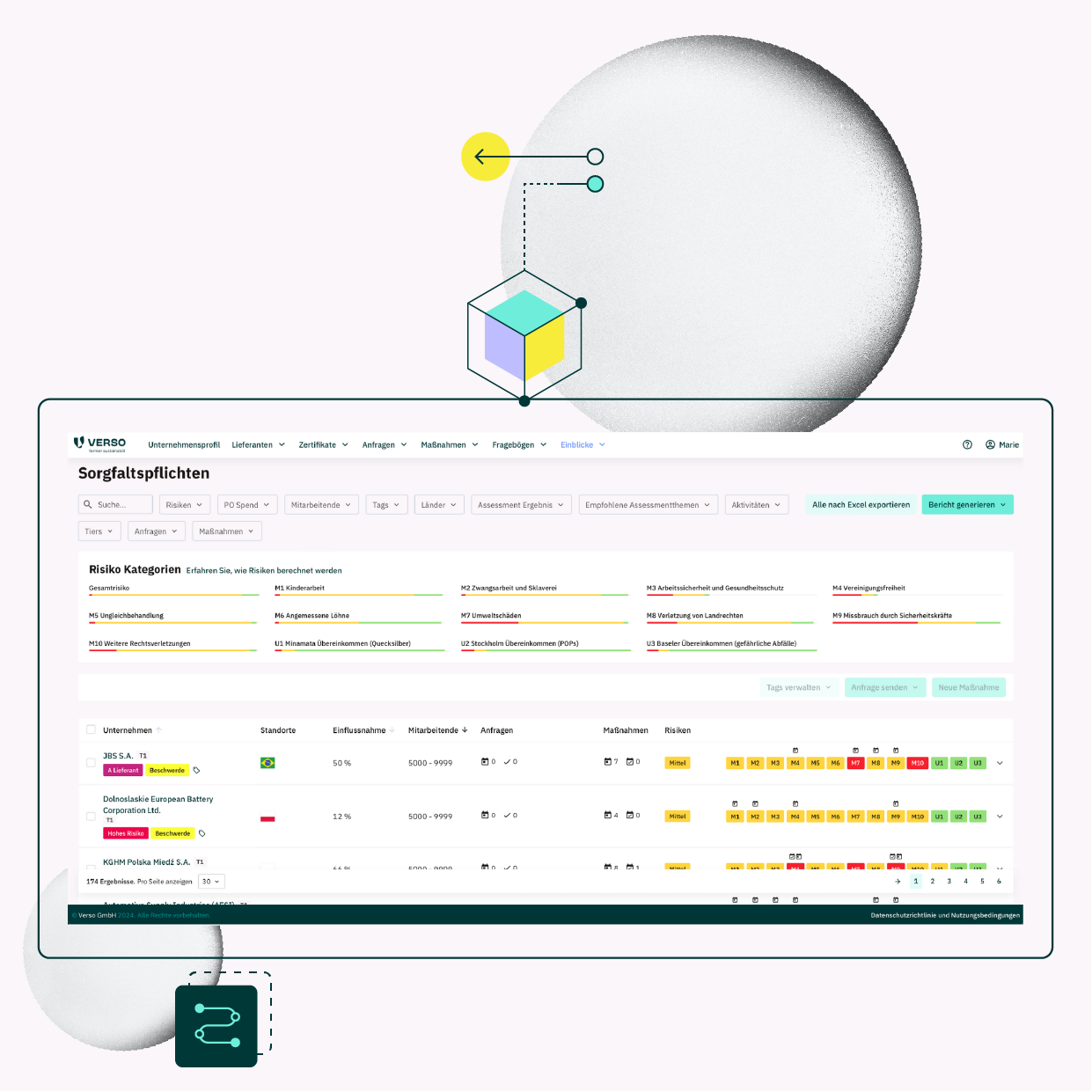

Supply chain transparency

… with the VERSO Supply Chain Hub. More than 100 ESRS data points relate to the supply chain – yet data collection is often challenging. VERSO gives you a complete overview of your supply chains, enabling you to meet your disclosure requirements with ease.

Carbon footprint and climate strategy

… with the VERSO Climate Hub. Whether carbon accounting, climate targets, or climate strategy: with VERSO, you collect robust data to efficiently meet the requirements of environmental standards such as ESRS E1.

References

Questions and answers on the CSRD reporting obligation

Who does the CSRD reporting obligation apply to – and from when?

According to the current status, the following are subject to CSRD reporting:

- From 2025 (report for 2024):

Companies that were already required to report under the NFRD / CSR-RUG

(e.g. large listed companies, banks, and insurance companies with>500 employees) - From 2028 (report for 2027):

Large companies with more than 1,000 employees and net annual revenue exceeding EUR 450 million - From 2029 (report for 2028):

Non-EU companies that generate net revenue of more than EUR 450 million in the EU and have a subsidiary or branch in the EU

What has changed as a result of the Omnibus decision?

With the Omnibus decision, the CSRD timeline and scope of application were significantly adjusted.

- The reporting obligation for many companies was postponed by two years.

- The scope of application was significantly narrowed.

No longer mandatorily subject to CSRD reporting are:

- Companies with fewer than 1,000 employees that were originally covered under the lower thresholds

(250 employees / EUR 50 million revenue) - Listed SMEs (expected to be fully removed from the mandatory scope)

- Micro-enterprises (still excluded, unchanged)

What does “double materiality” mean in the CSRD?

With the CSRD reporting obligation comes a new understanding of materiality. More specifically, relevant topics for the sustainability report are now identified based on double materiality. Companies are therefore required to report both on the impacts of their business activities on people and the environment, and on the effects of sustainability aspects on the company itself. Double materiality thus replaces the previous rule under which companies were only required to report if both materiality dimensions applied. Our experienced sustainability experts are happy to support you with the materiality analysis as well as throughout the entire reporting process.

How do CSRD, SFDR, and the EU Taxonomy relate to each other?

You are likely already aware that the CSRD reporting obligation is a key part of implementing the European Green Deal. But how does it all fit together with the other directives and regulations?

CSRD (Corporate Sustainability Reporting Directive):

EU Taxonomy: It defines which economic activities can be classified as sustainable.

SFDR (Sustainable Finance Disclosure Regulation): It requires financial market participants to disclose sustainability information.

How do I combine my annual and sustainability reports in a meaningful way?

With the introduction of the CSRD reporting obligation, business and sustainability reporting are closely linked. VERSO not only provides you with audited annual and sustainability reports from a single source, but also combines both into a holistic report that meets all legal requirements. For maximum transparency in your sustainability reporting.

Book your Demo!

Get to know the VERSO software for implementing the CSRD reporting obligation in practice.